Initial Business Setup

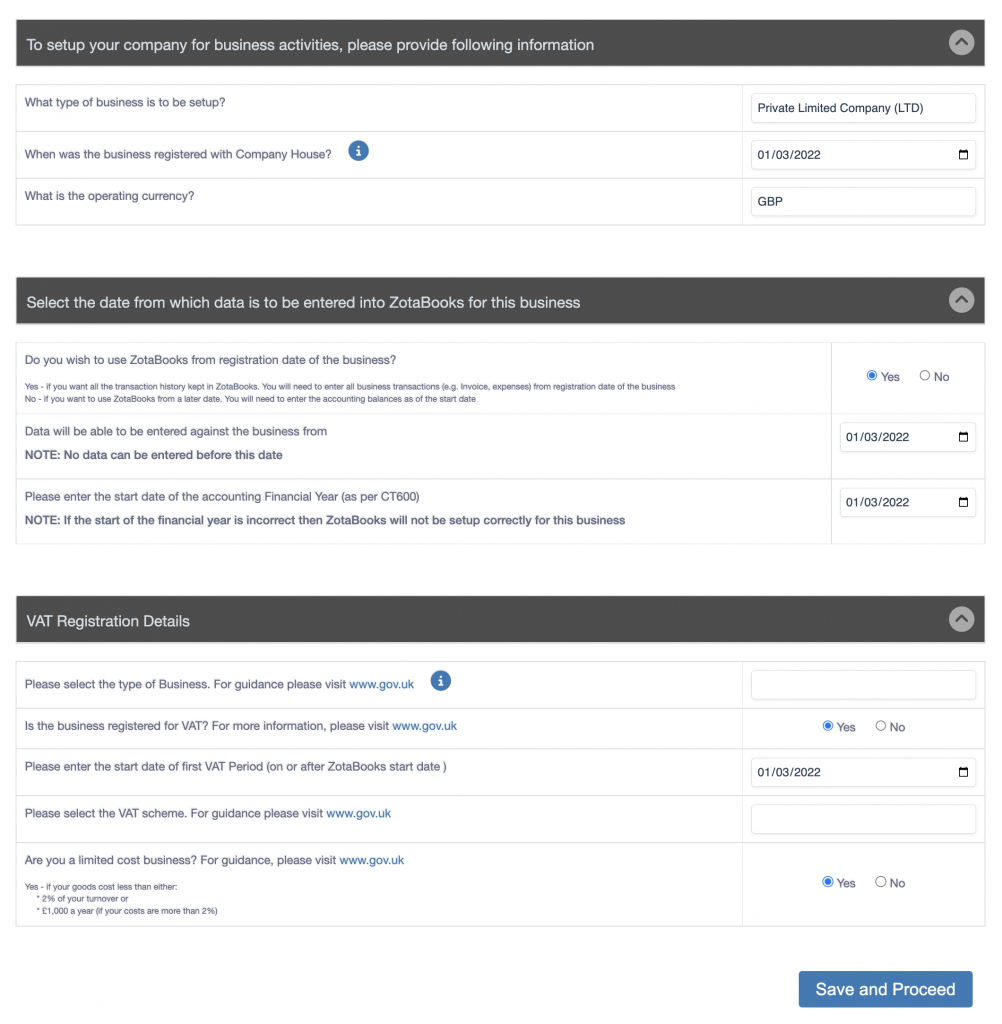

The first time a new business is accessed the “Initial Business Setup” screen is displayed (see below), this has information about how the business will be setup in ZotaBooks. The initial setup screen is made up of three sections:

- Business type, registration with Companies House and currency of the business

- Date from which ZotaBooks will be used for the business

- VAT registration details

Each of these sections is discussed below. It is very important that the companies are setup correctly.

Business type, registration with Companies House and currency of the business

Click here to learn about setting up a business on the government website.

There are four business types available in ZotaBooks:

- sole trader, click here to learn about a sole trader from the government website

- partnership, click here to learn about a partnership from the government website

- private limited company, click here to learn about a limited company from the government website

- public limited company, click here to learn about a limited company from the government website

When the business was setup a decision would have been taken as to the type of business being setup.

Enter the date the company was setup, for businesses registered with Companies House this will be the date the business was registered with Companies House.

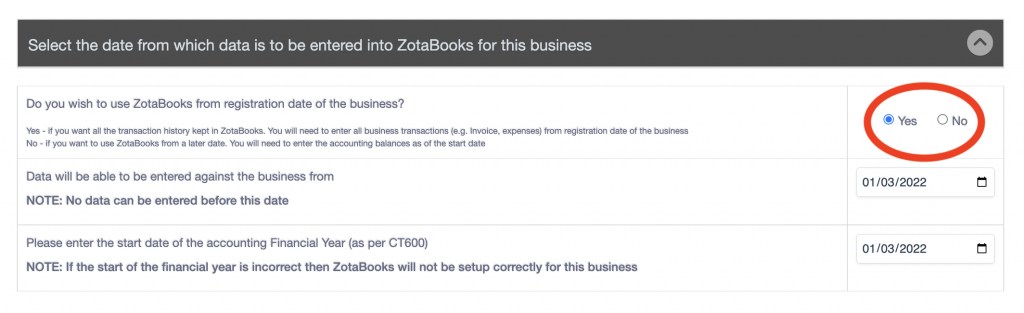

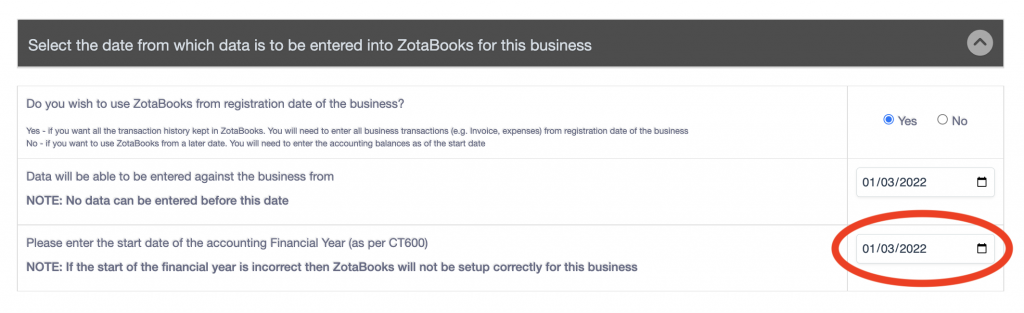

Date from which ZotaBooks will be used for the business

The decision is from what date transactions will be entered into ZotaBooks for the business. The earliest date transactions can be entered is 1st January 2015.

If the business was registered on or after 1st January 2015 then ZotaBooks can be used from the start of the business. The first question (outlined in red below) asks whether ZotaBooks will be used from the registration date of the business (answer yes) or from a later date (answer no).

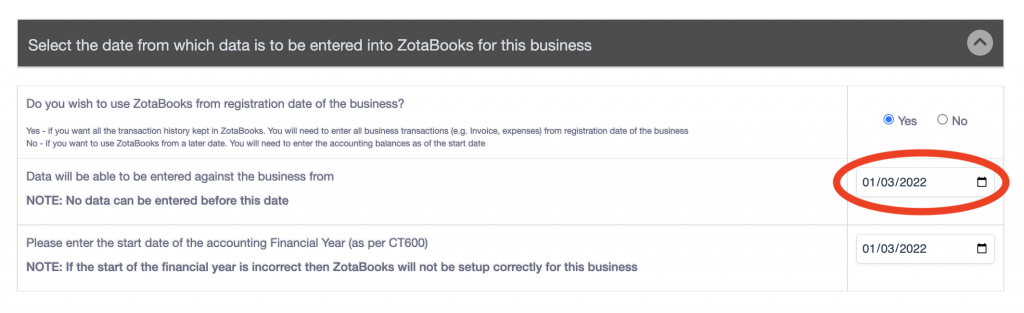

Select the date from which ZotaBooks is to be used to record transactions for the business (outlined in red below). Be aware NO transactions can be entered BEFORE the date specified.

Finally enter the start date of the financial year from which ZotaBooks is to be used.

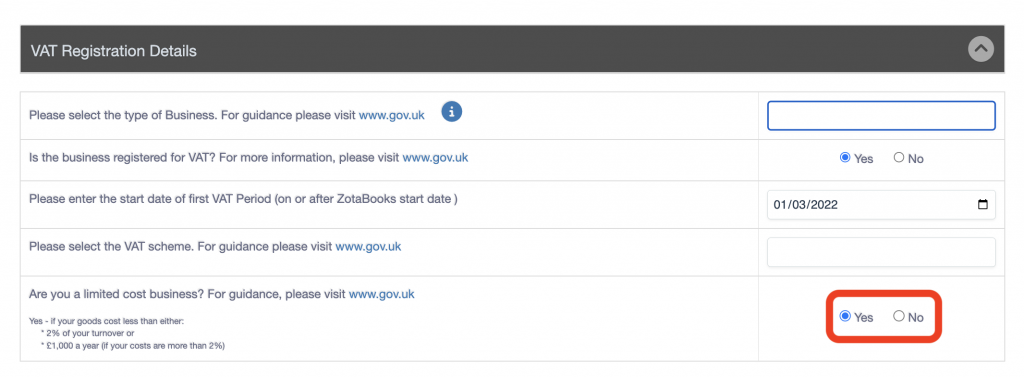

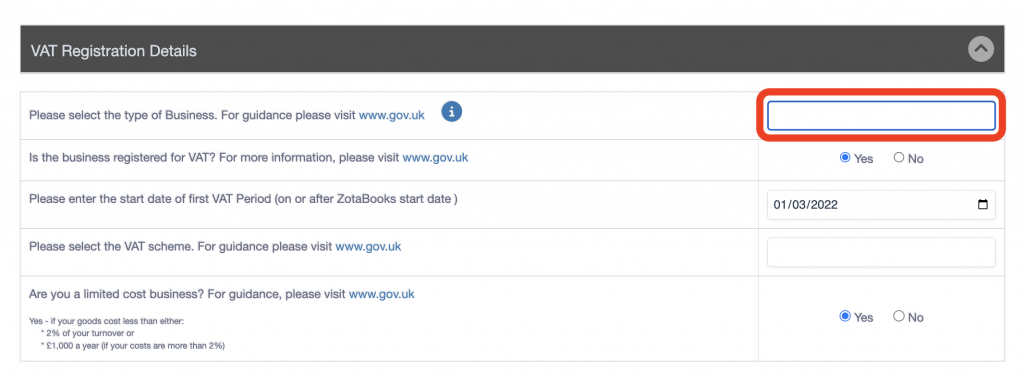

VAT Registration Details

Select the type of business from the drop down list, this is used to select the VAT Rate applicable to the business.

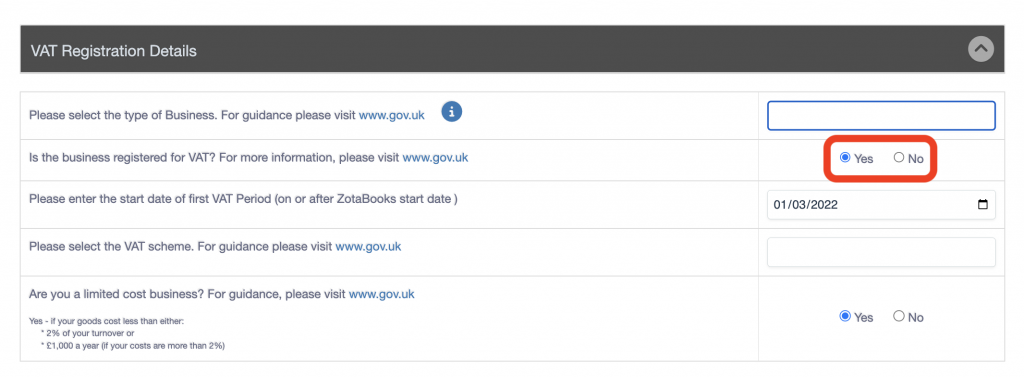

For “Is the business registered for VAT?” select either:

- Yes, if the business is VAT registered

- No, if the business if not VAT registered.

Click here to visit the government website to learn about VAT registration.

Enter the start date of first VAT period, this will default to the date set for the start date of the business (section above).

Select the VAT scheme the business is registered under:

- VAT Standard Scheme,

- VAT Flat Rate Scheme (click on this link to learn about the VAT Flat Rate Scheme on the government website)

Select if the business is a limited cost business or not (Yes = is a limited cost business, No = is not a limited cost business). Click here to learn about limited cost business from the government website.