Invoice Received User Guide – Invoice Received with CIS

When an invoice is received by the business and the business is not Construction Industry Scheme (CIS) registered then the user guides in this section are applicable.

Create New Invoice Received Entry

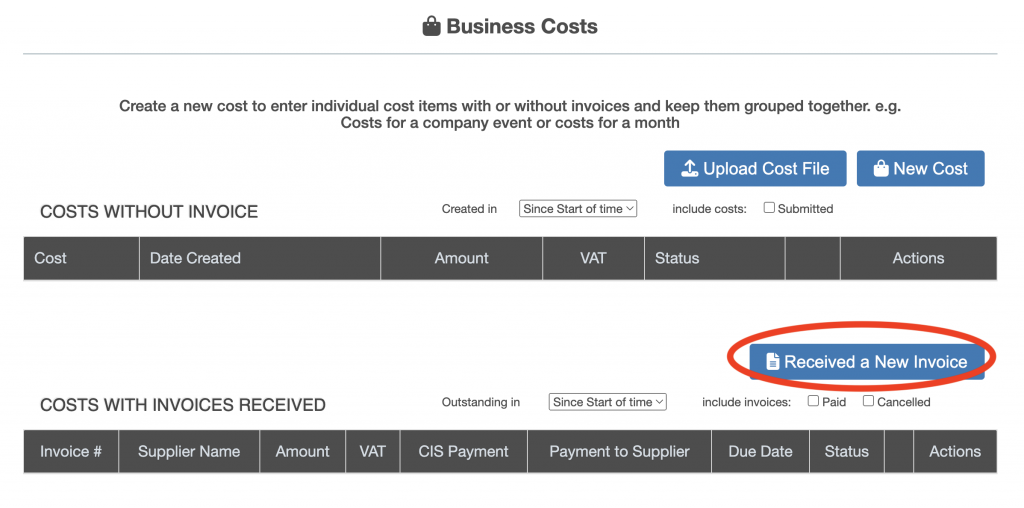

Press the “Received a New Invoice” button on the “Business Costs” screen.

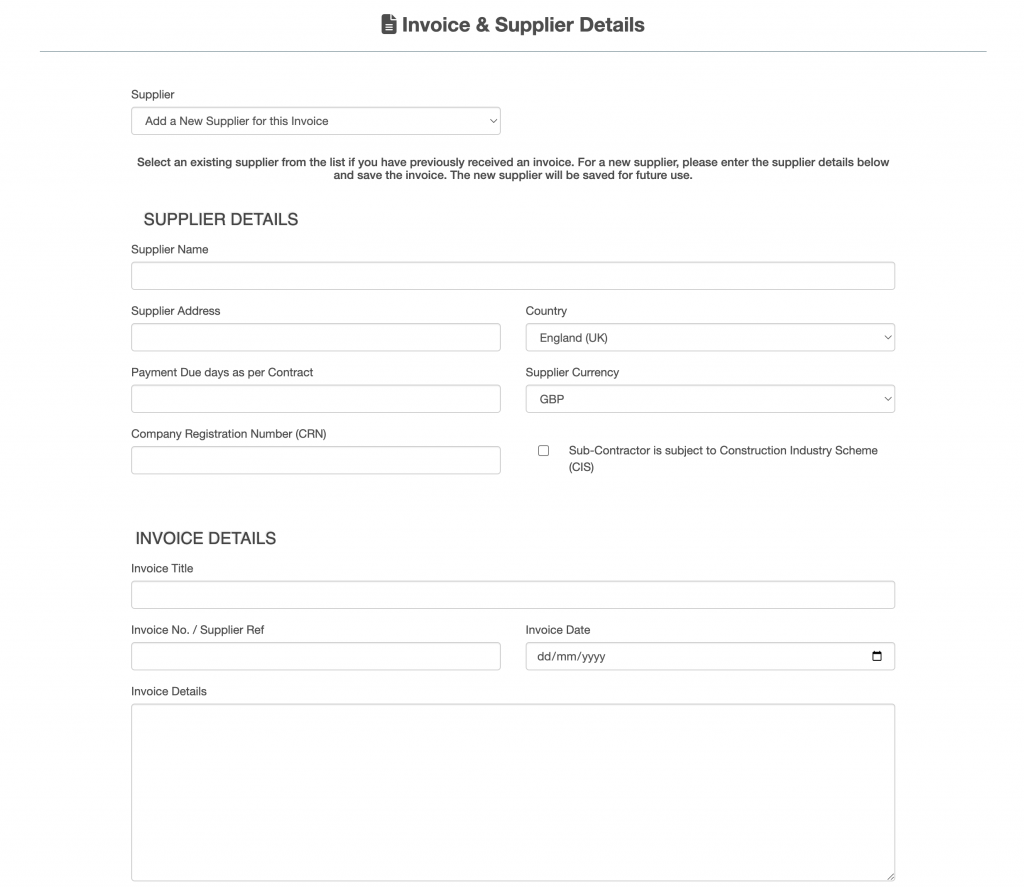

The invoice received entry is displayed.

The first step is to select a supplier either:

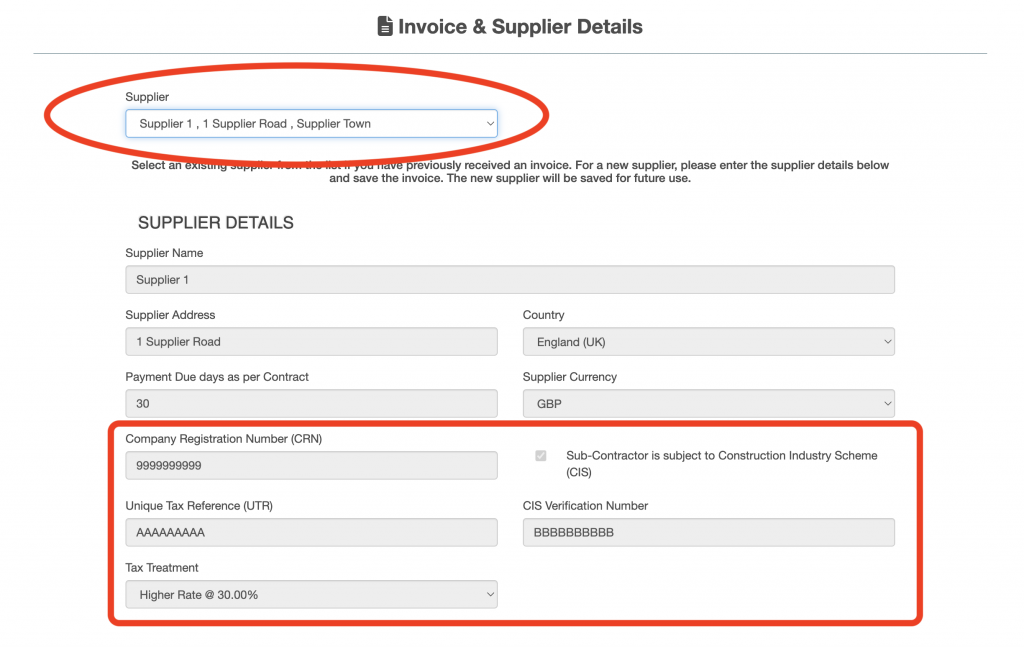

- select a supplier from the supplier drop down list (circled in red below), the Supplier Details will be populated, or

- do not select a supplier from the supplier drop down list, enter the Supplier Details.

For a supplier subject to CIS the check box “Sub-Contractor is subject to Construction Industry Scheme (CIS)” will be ticked for a selected supplier, where the supplier is entered on this screen the check box must be checked.

For a supplier subject to CIS the Unique Tax Reference, CIS Verification Number and Tax Treatment will be completed. Where the supplier is entered on this screen the Unique Tax Reference, CIS Verification Number and Tax Treatment must be entered.

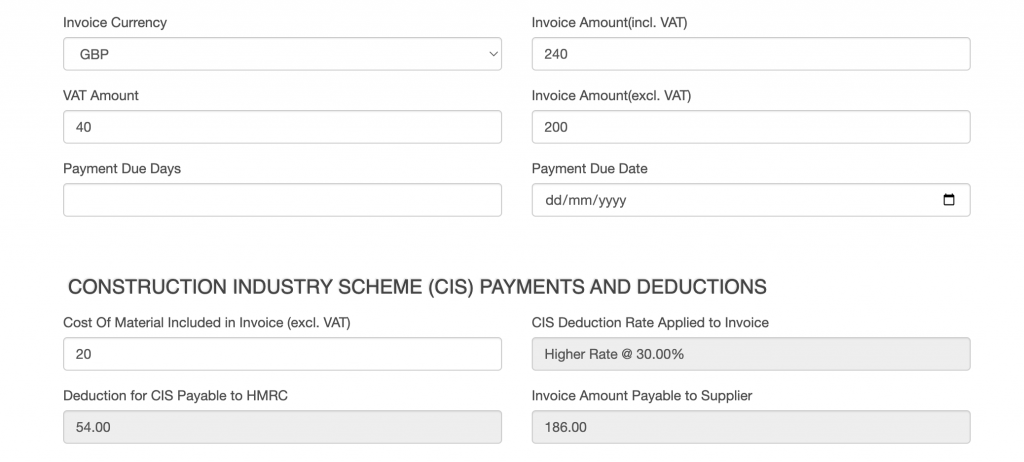

At the bottom of the screen there is an option to enter “Cost of Material Included in Invoice (excl. VAT)”, where this is not supplied

Enter the invoice details. The “Deduction for CIS Payable to HMRC” and “Invoice Amount Payable to Supplier” is automatically calculated.

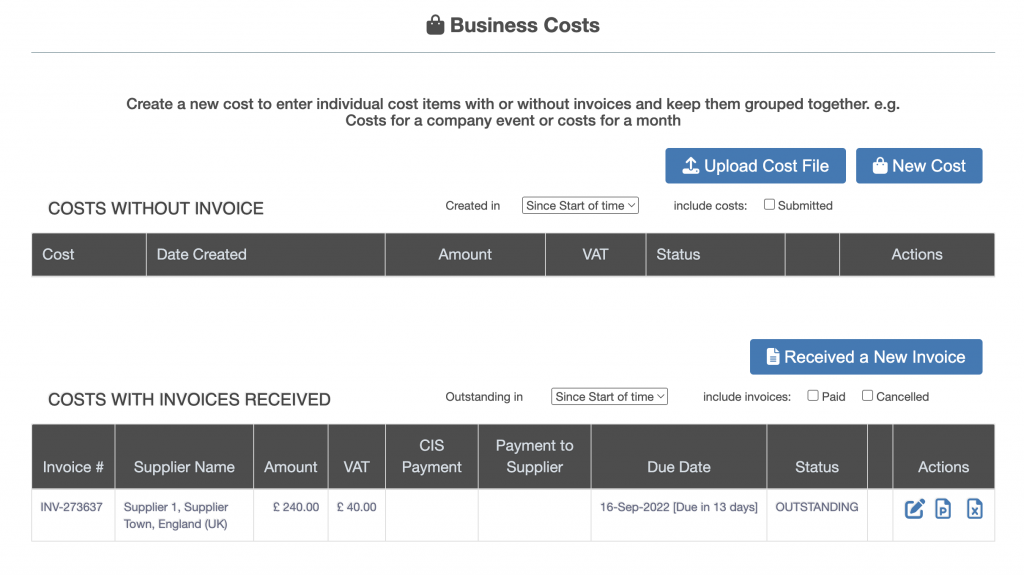

Press the “Save” button. A new invoice received is displayed under “Costs with Invoices Received”.