Partner Share User Guide

Partner Share is only applicable to business which are setup as a partnership.

If a business is setup as sole trader, private limited company or public limited company then partner share will not be available in the left hand menu.

If a business is setup as a private limited company or public limited company then “Dividend” will be available on the left hand menu. Dividend manages the distribution of profit for a private limited company or public limited company based on company shares held by each shareholder. Click here to view dividends.

In order to declare a partner share profit distribution a partnership must have partners setup.

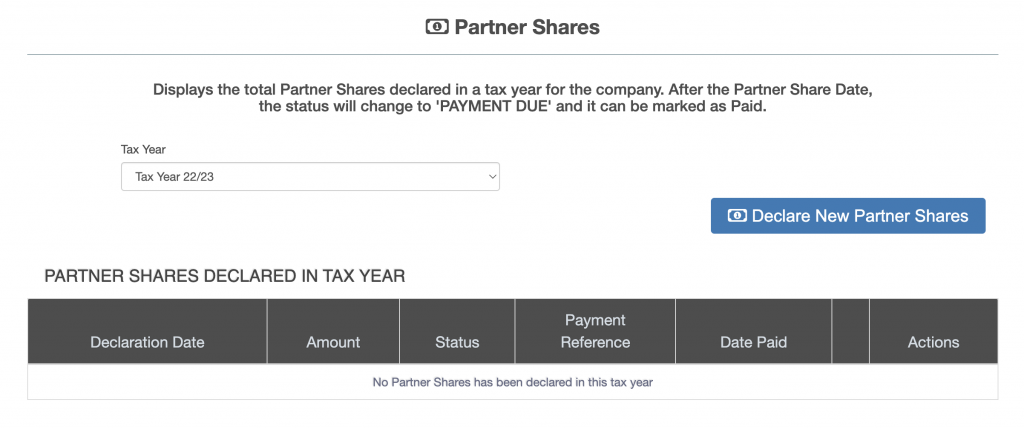

From the left hand menu select “Partner Share”. The “Partner Share” screen is displayed.

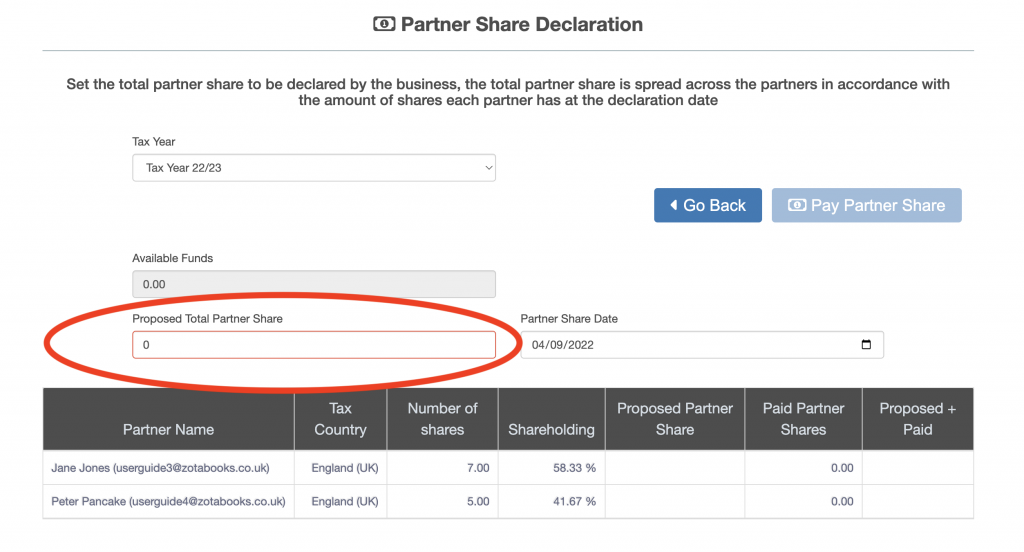

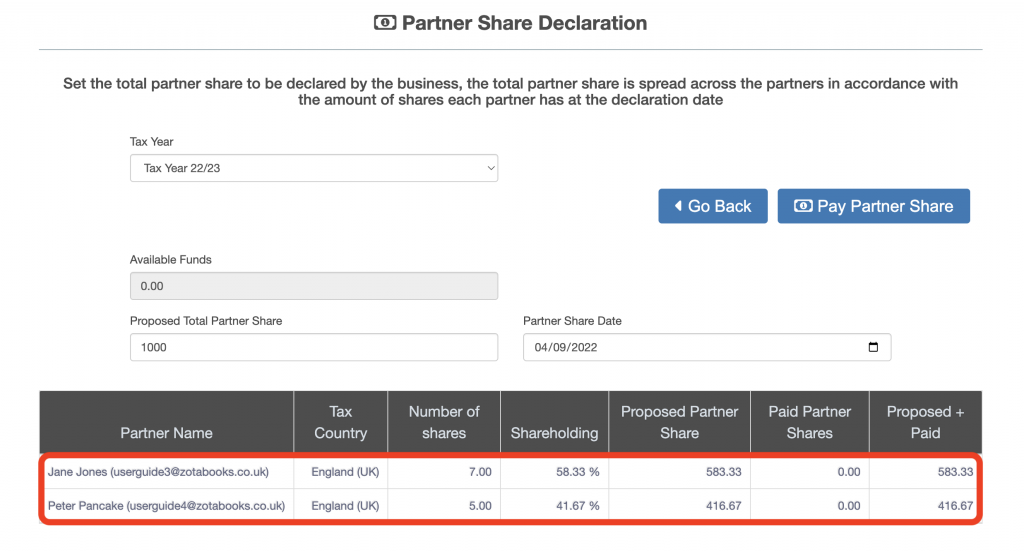

The “Declare Partner Share” screen is displayed. Enter the proposed total partner share, the available funds are displayed above. Enter the dividend payment date.

When the proposed total partner share is entered it will be apportioned across the partners based on the partner shares held which is displayed in the table below.

Press the “Pay Partner Share” button. The partner share will be paid at the end of the day for the day specified.