Payroll User Guide – Add Employee To Payroll – Set Employee Tax Code

Each time a new user is added as an employee to the payroll a default tax code is added which is the emergency tax code 1257L M1.

It is important that the tax code is amended to reflect the actual tax code for the employee to ensure correct tax and national insurance calculation.

From the left hand menu select “Payroll” under “Business”.

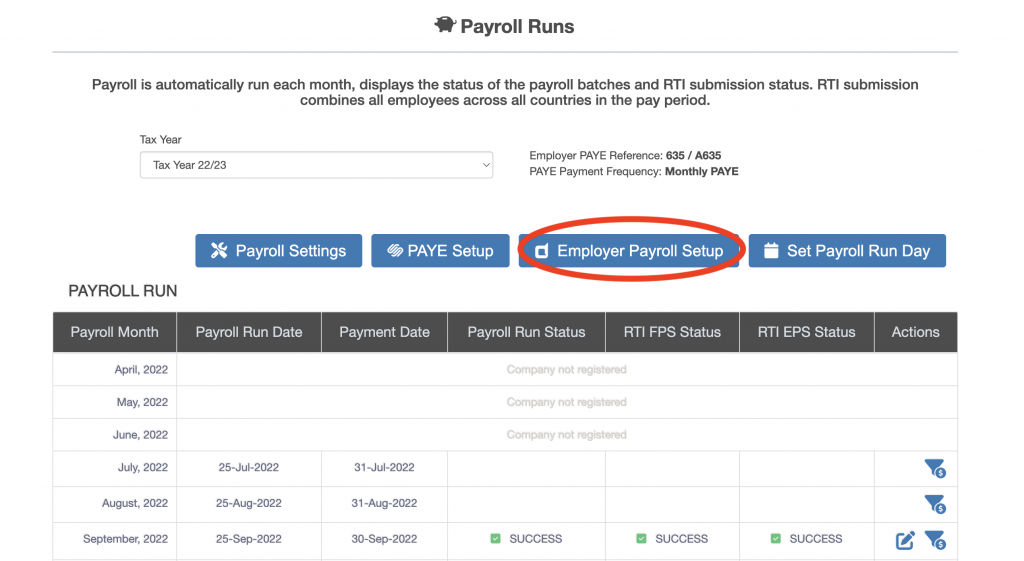

The Payroll screen is displayed. Press the “Employer Payroll Setup” button (circled in red below).

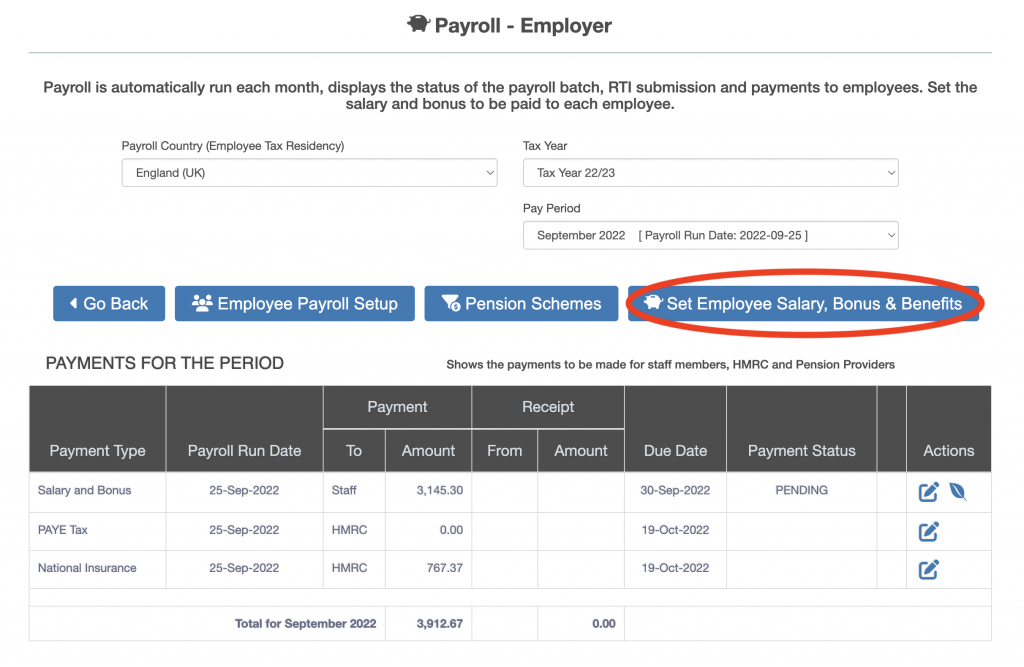

The “Payroll – Employer” screen is displayed. Press the “Set Employee Salary, Bonus & Benefits” button (circled in red below).

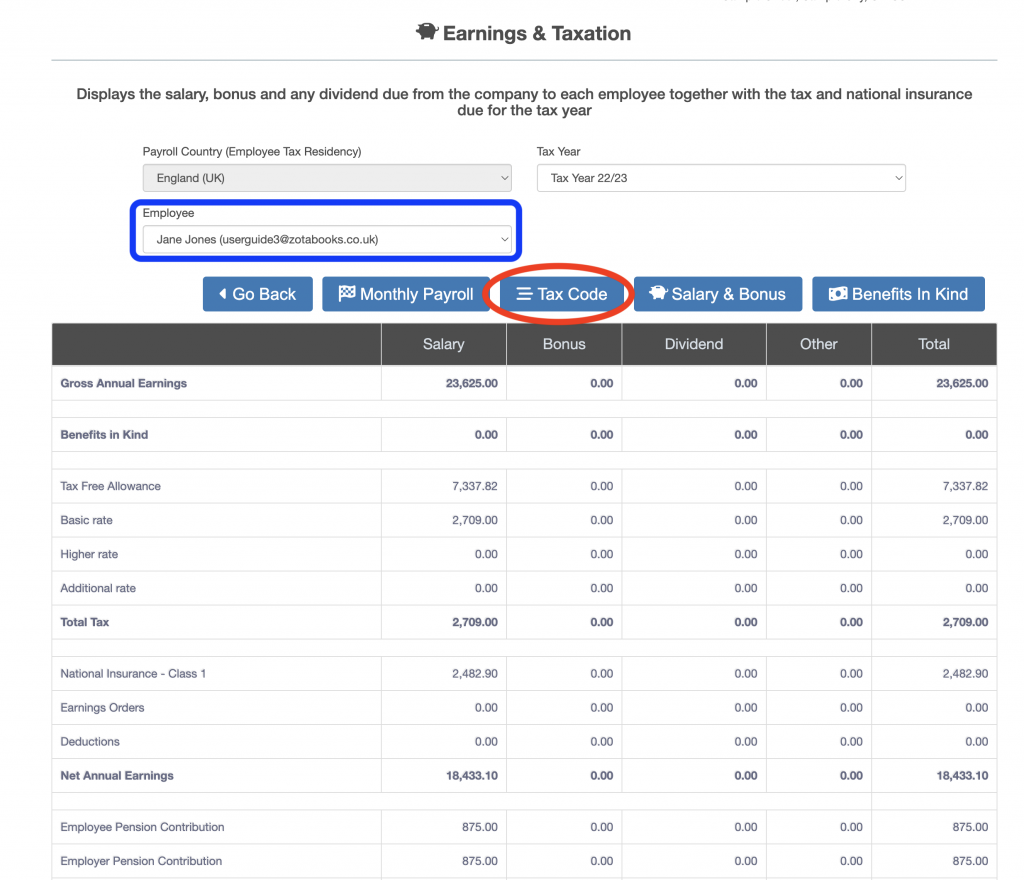

The “Earnings & Taxation” screen will be displayed. Press the “Tax Code” button (circled in red below). Select the Employee for whom the tax code is to be updated (outlined in blue below).

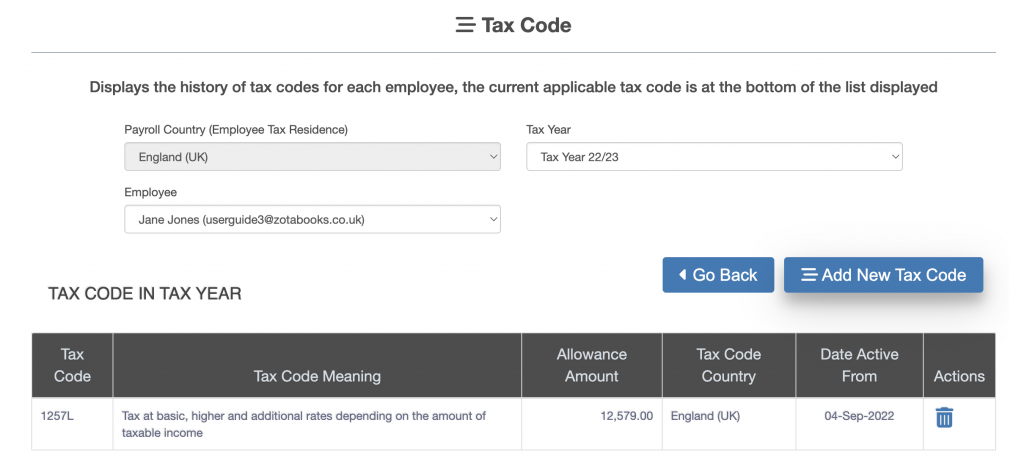

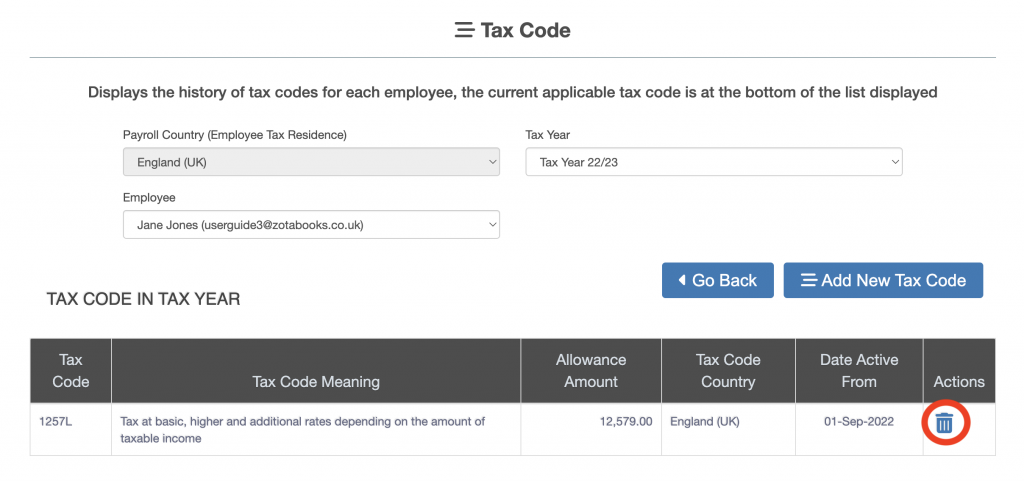

The “Tax Code” screen will be displayed.

Delete an Existing Tax Code

To delete the default emergency tax code (or any other tax code) click the delete tax code icon (trash can, circled in red below).

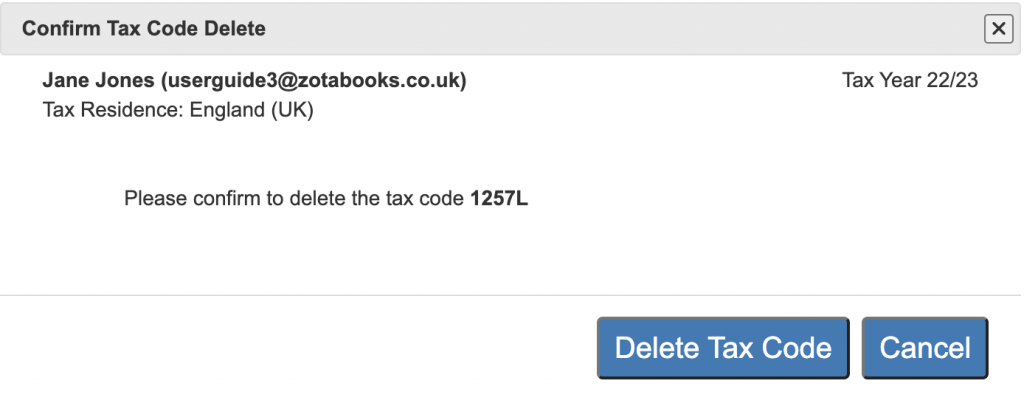

The confirm tax code deletion dialog box will be displayed (see below).

To delete the tax code press the “Delete Tax Code” button, to stop the deletion of the tax code press the “Cancel” button. Once the tax code is deleted the entry in the tax code listing screen will appear.

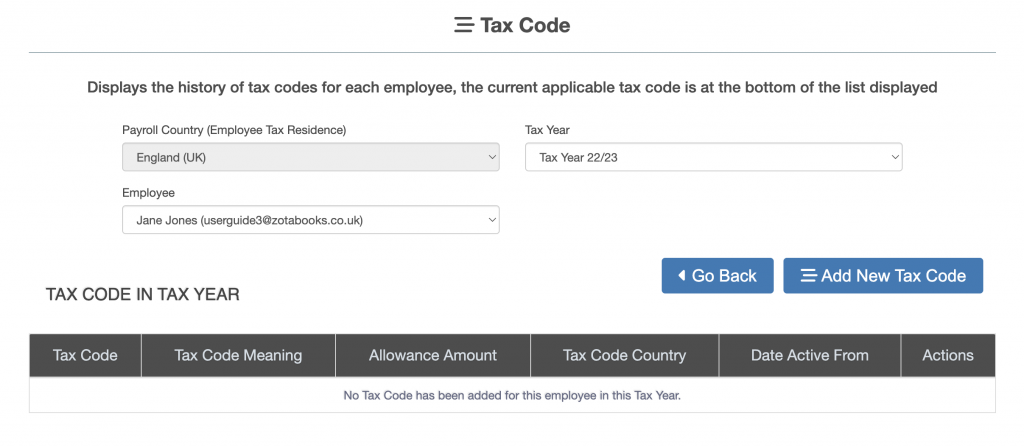

Add a Tax Code

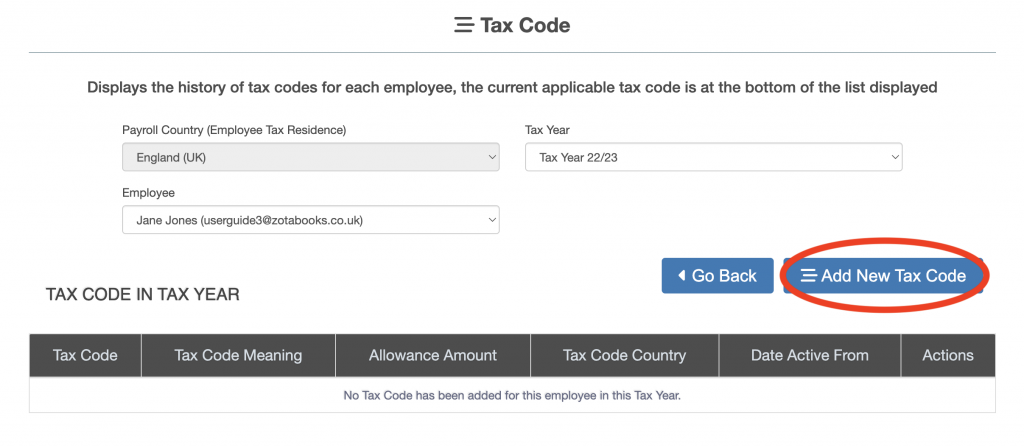

Press the “Add New Tax Code” button (circled in red below).

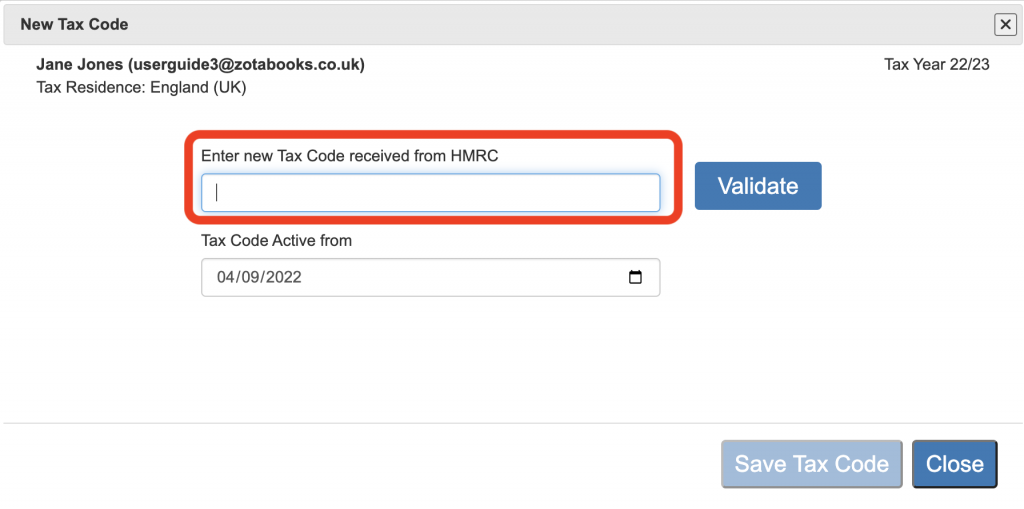

The “Add Tax Code” dialog box is displayed. Enter a new tax code (outlined in red below).

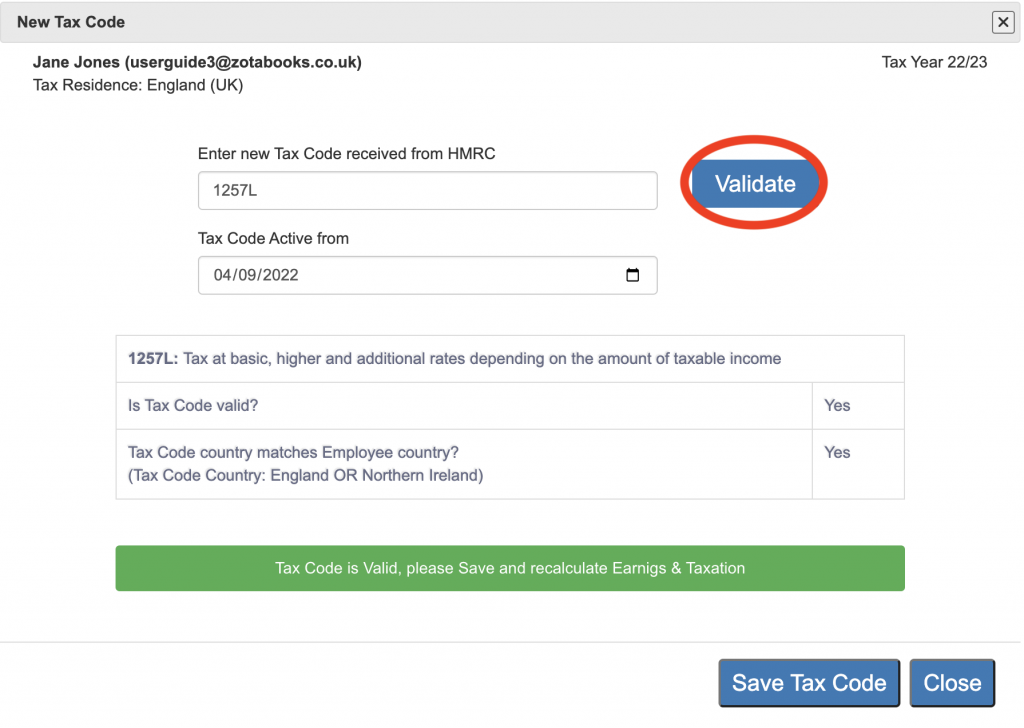

Then press the “Validate button” (circled in red below), if the tax code is passes validation then the “Tax Code is Valid” message will appear in green highlighted text at the bottom of the dialog box (as per below).

Press the “Save Tax Code” button. The new tax code will be added to the employee, the tax and national insurance will be automatically recalculated and stored.