Payroll User Guide – Add Pension Scheme

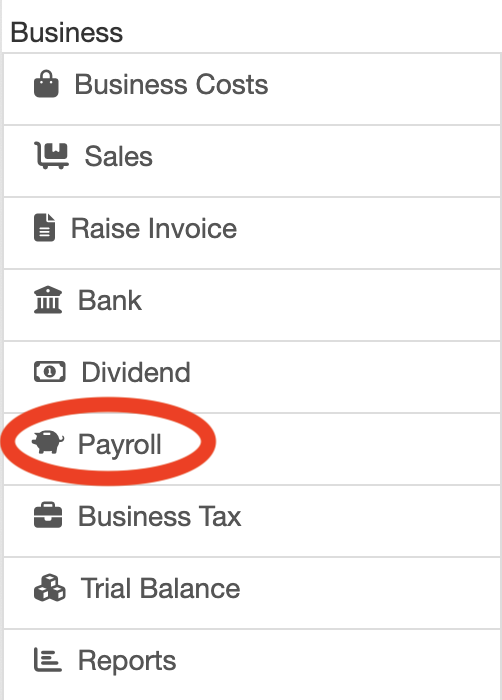

From the left hand menu select “Payroll” under “Business”.

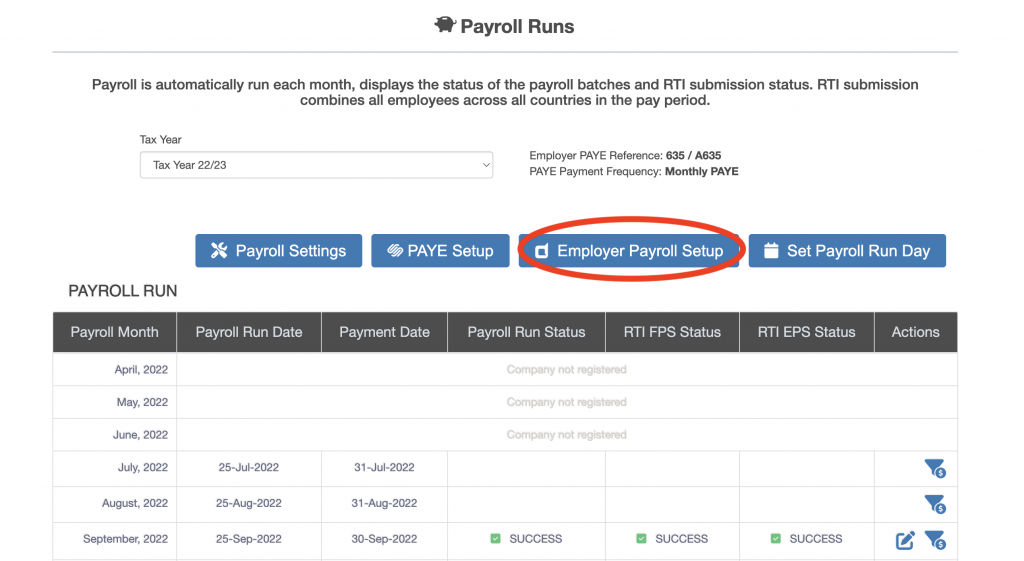

The Payroll screen is displayed. Press the “Employer Payroll Setup” button (circled in red below).

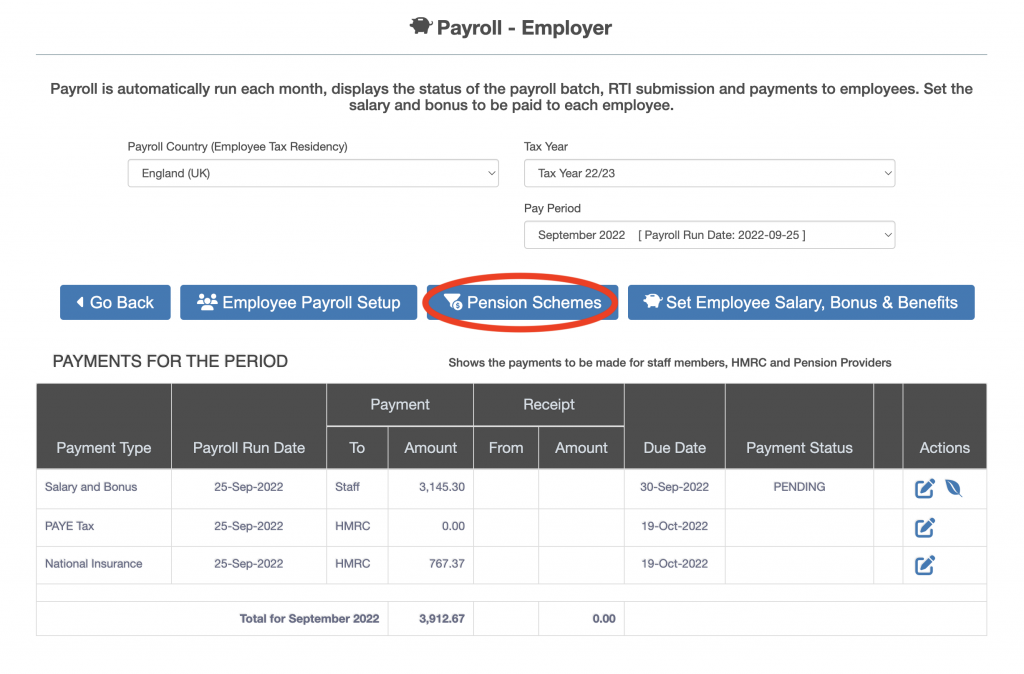

The “Payroll – Employer” screen is displayed. Press the “Pensions Schemes” button (circled in red below).

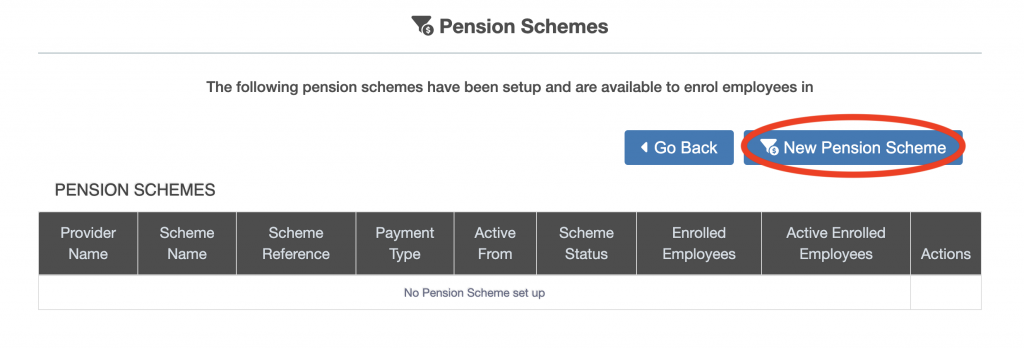

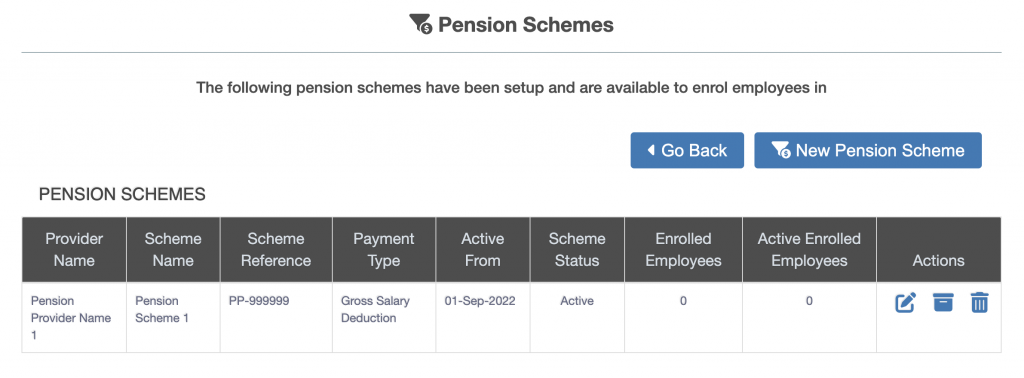

The “Pension Schemes” screen is displayed. To add a new pension scheme press the “New Pension Scheme” button.

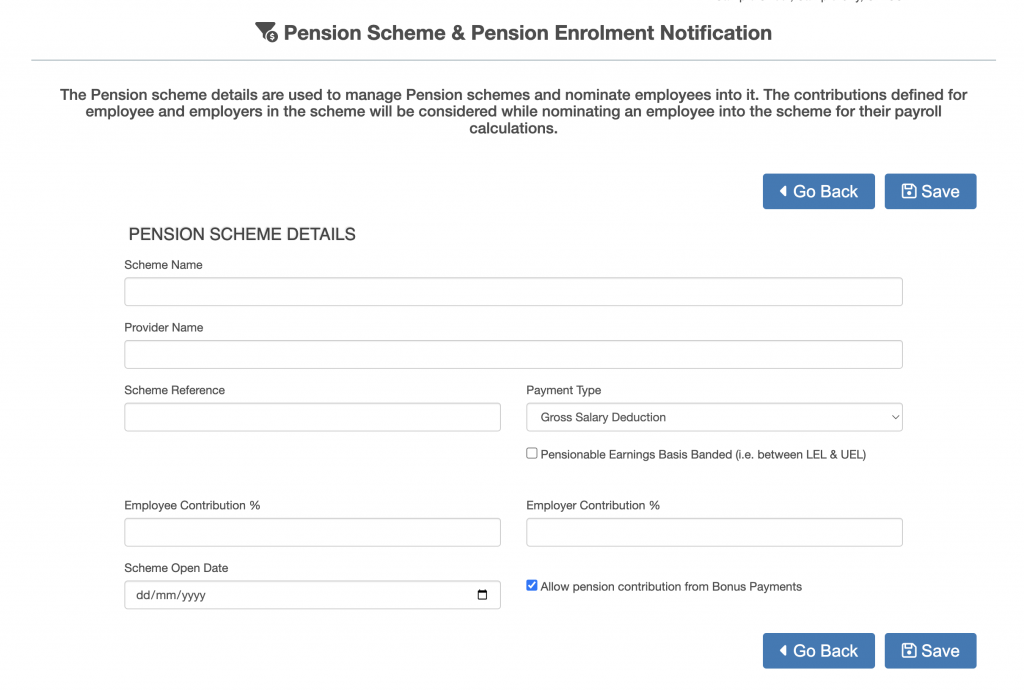

The “New Pension Scheme” screen is displayed. Complete the pension scheme details.

- Payment Type, this enables selection between “Gross Salary Deduction” and “Net Salary Deduction” for employee pension contributions.

- If pensionable earnings are to be banded between the Lower Earnings Level (LEL) and the Upper Earnings Level (UEL) then tick the “Pensionable Earnings Basis Banded (i.e. between LEL & UEL)” check box.

- If bonus payments are to be subject to pension contributions tick the “Allow pension contribution from Bonus Payments” check box.

Once the pension scheme details have been entered press the “Save” button.

The pension scheme is added to the list of pension schemes.