Payroll User Guide – Payroll Setup

Setting up payroll involves the following:

- Setup HMRC Payroll References & PAYE Payment Frequency

- Subscribe ZotaBooks to HMRC RTI

Setup HMRC Payroll References & PAYE Payment Frequency

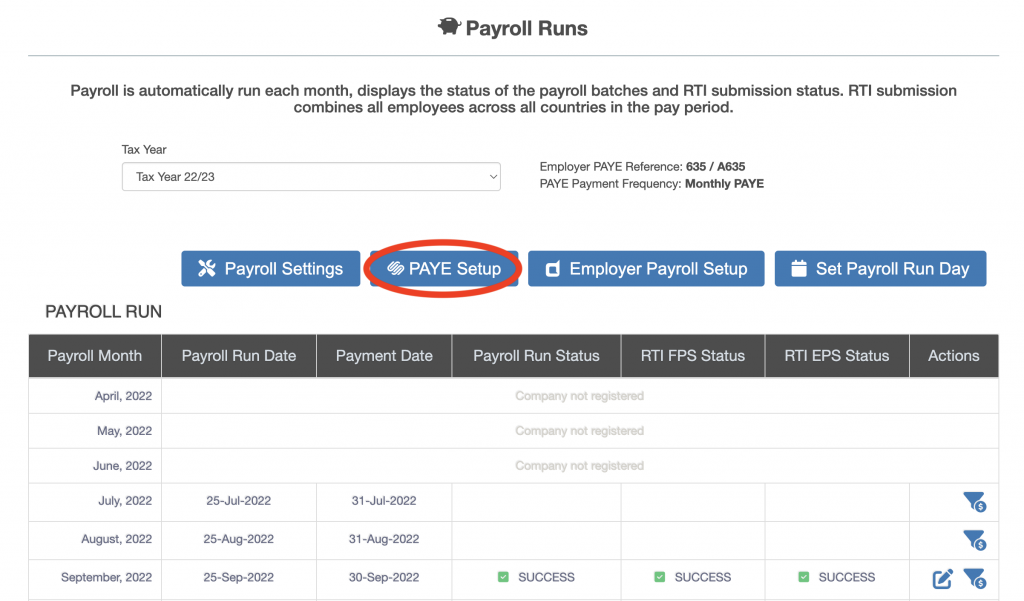

Each business setup in ZotaBooks which is registered with HMRC for payroll needs to have the HMRC payroll references setup. From the left hand menu select “Payroll” from “Personalisation”.

The “Payroll” screen is displayed, for the current business, press the “PAYE setup button” (circled in red below).

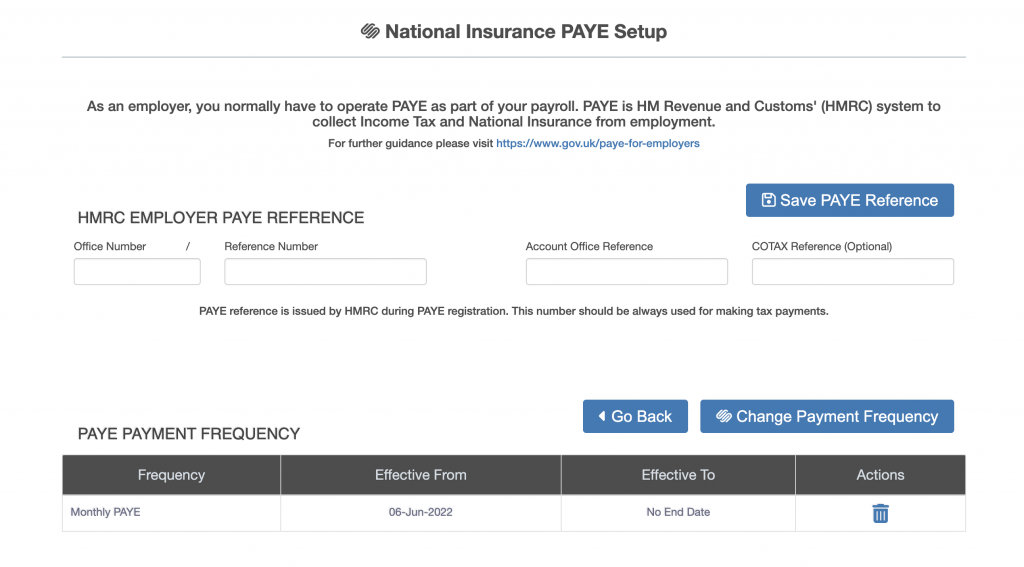

The “PAYE Setup” screen is displayed.

- Under HMRC Employer PAYE Reference (Only set this up if the business is registered with HMRC for payroll)

- Office Number (Mandatory),

- Reference Number (Mandatory),

- Account Office Reference (Mandatory),

- COTAX Reference (Optional),

- Then press the “Save PAYE Reference” button.

- Under PAYE Payment FrequencyPress the “Change Payment Frequency” button

- Select payment frequency in the blank line

- Check and amend if necessary the effective from date

- Press the “Save” icon