Personalise – Business Setup User Guide – PAYE Setup

Setting up payroll involves the following:

- Setup HMRC Payroll References & PAYE Payment Frequency

- Subscribe ZotaBooks to HMRC RTI

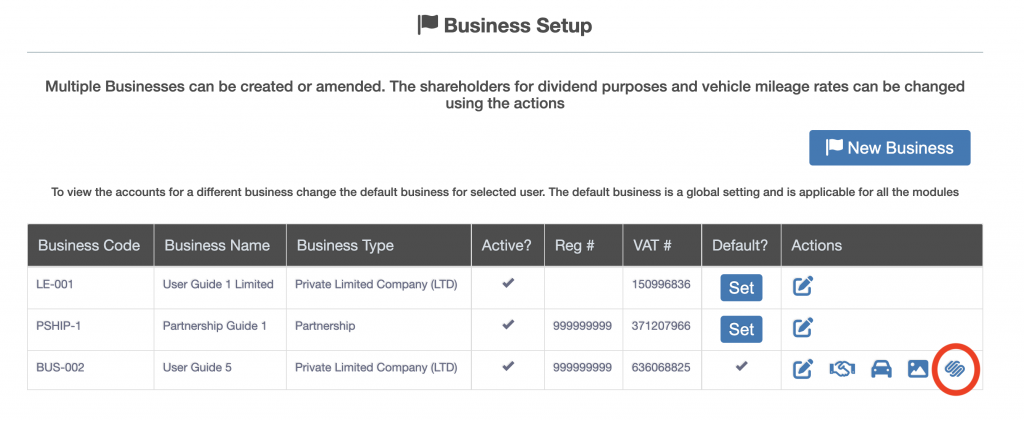

From the left hand menu select “Business Setup”. The “Business Setup” screen is displayed. Click the “PAYE” icon (circled in red below).

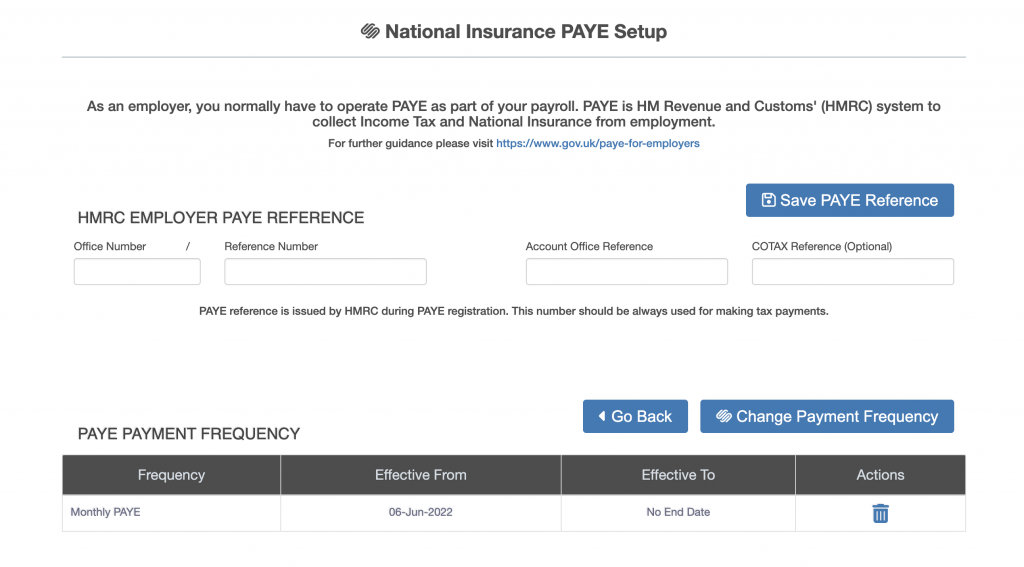

Click the “PAYE” icon. The “PAYE Setup” screen is displayed.

- Under HMRC Employer PAYE Reference (Only set this up if the business is registered with HMRC for payroll)

- Office Number (Mandatory),

- Reference Number (Mandatory),

- Account Office Reference (Mandatory),

- COTAX Reference (Optional),

- Then press the “Save PAYE Reference” button.

- Under PAYE Payment FrequencyPress the “Change Payment Frequency” button

- Select payment frequency in the blank line

- Check and amend if necessary the effective from date

- Press the “Save” icon