Payroll User Guide – Add Employee To Payroll – Employee Migrated

If the user is a new employee joining the business do not complete this guide and go to the new payroll joiner guide.

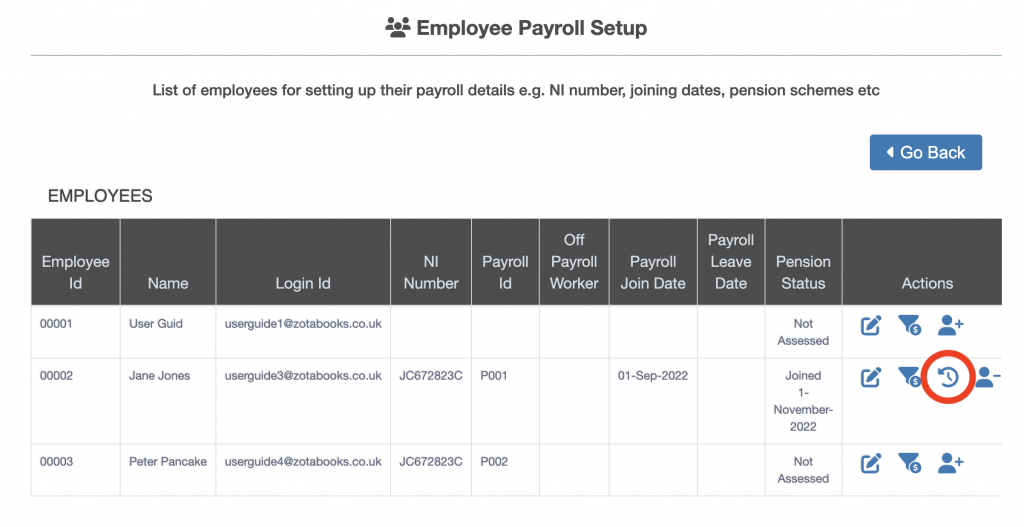

In the “Employee Payroll Setup” screen (click here to learn how to access the Employee Payroll Setup” screen) click the “Edit Previous Employment Details” icon (circled in red below).

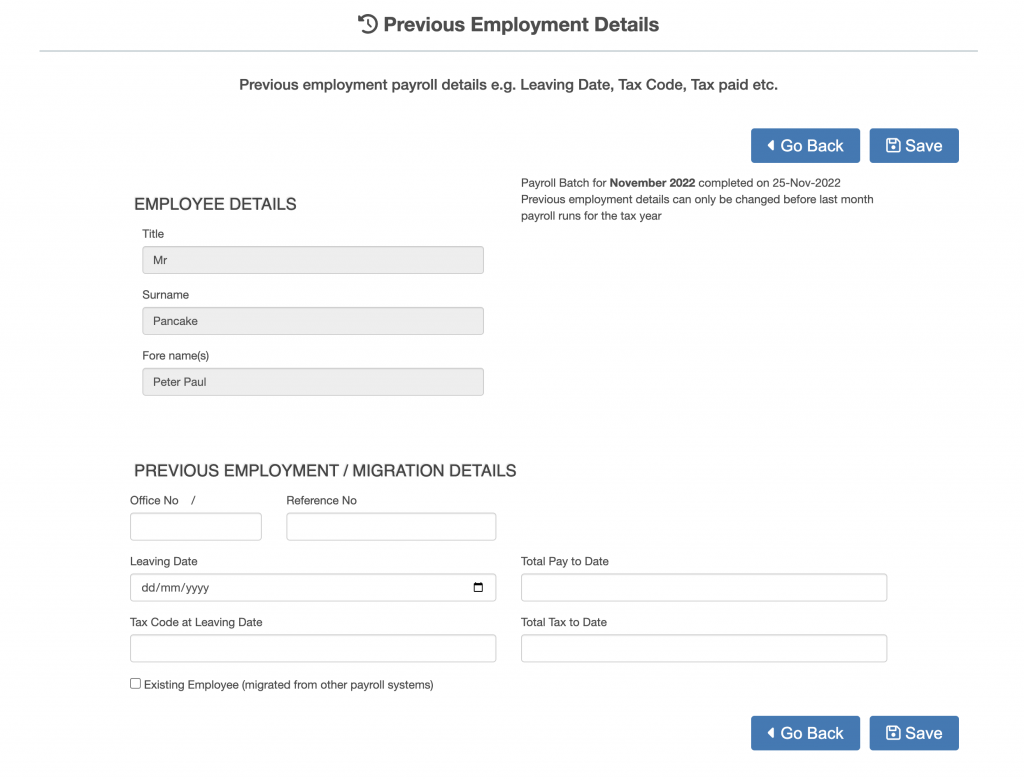

Once the “Edit Previous Employment Details” icon is pressed the “Previous Employment Details” screen will be displayed.

Enter the following details:

- Office No.

- Reference No.

- Leaving Date.

- Total Pay to Date.

- Tax Code at Leaving Date.

- Total Tax to Date.

Where the user is an existing employee migrated onto the payroll from another payroll software then tick the check box “Existing Employee (migrated from other payroll systems)”.

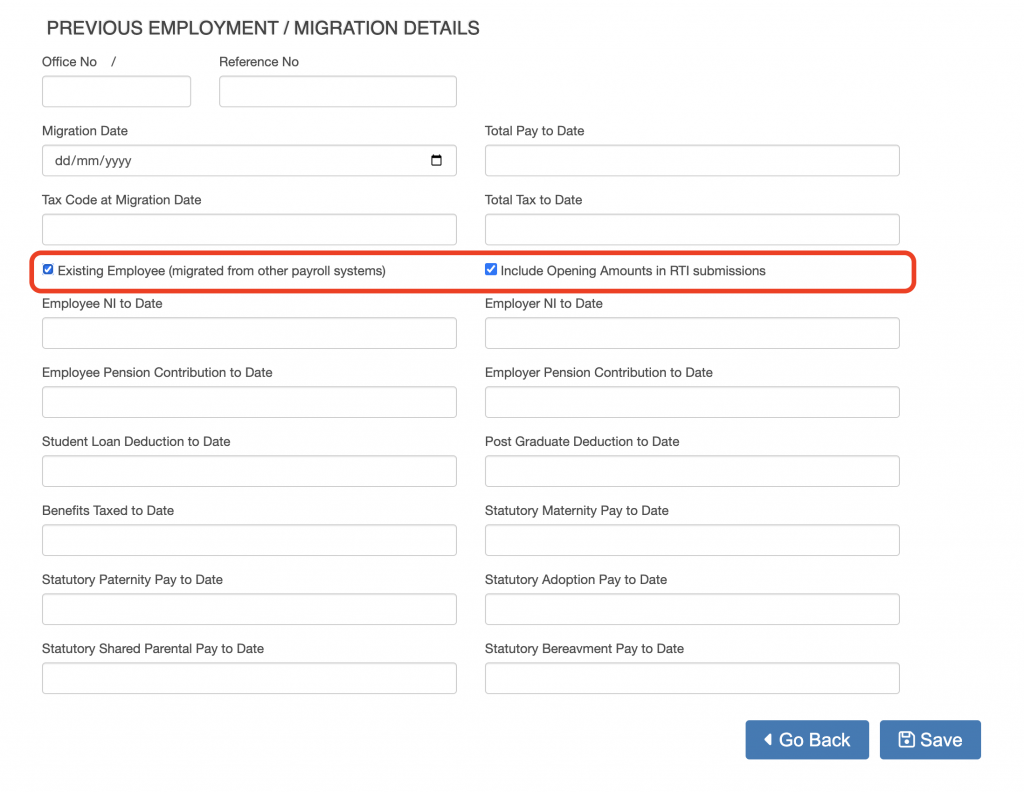

When the “Existing Employee (migrated from other payroll systems)” is ticked the Year to Date payroll figures for the employee can be entered. The “Include Opening Amounts in RTI Submissions” is ticked as default, this includes the Year to Date numbers entered in the Year to Date figures sent to HMRC in RTI. Unticking removes the Year to Date numbers entered in the Year to Date figures and excludes them from being sent to HMRC in RTI, the YTD figures sent to HMRC will only be what is generated in ZotaBooks (outlined in red below).

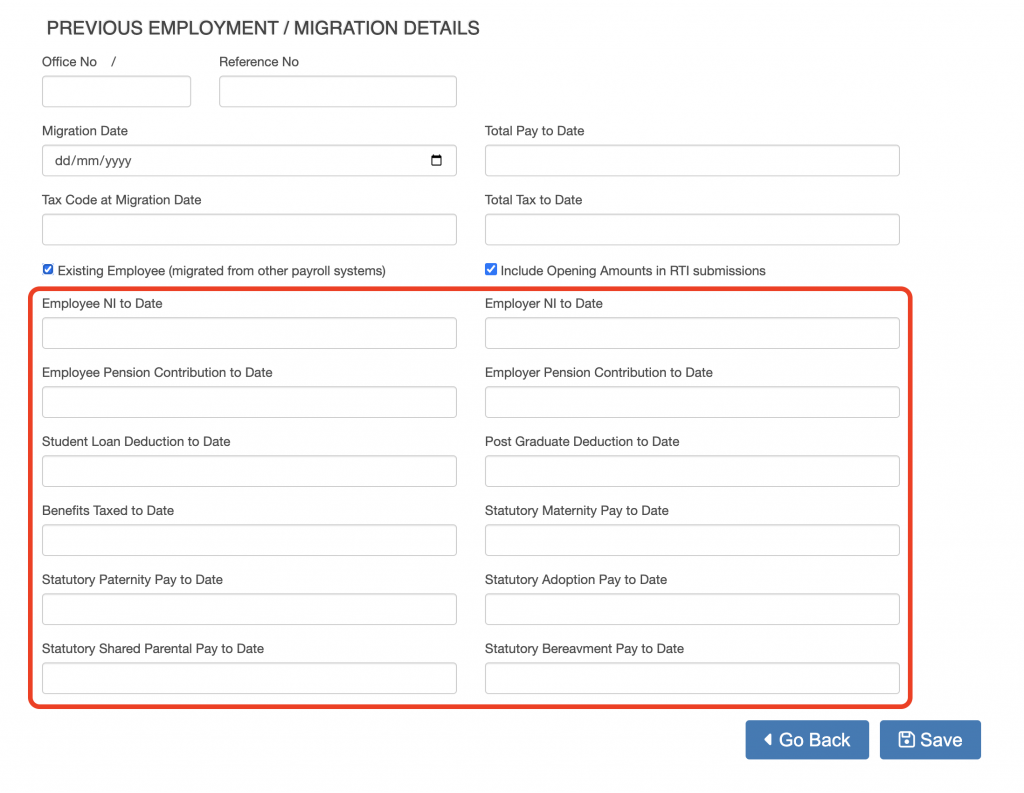

Once the check box is ticked additional fields will appear (outlined in red below).

Complete the details then press the “Save” button.