Payroll User Guide – Review / Edit Off Payroll Worker Payments

Once an off-payroll worker has been setup and the off-payroll worker has entered the hours worked in the timesheet, the payments due to be made to the off payroll worker can be reviewed and edited if required.

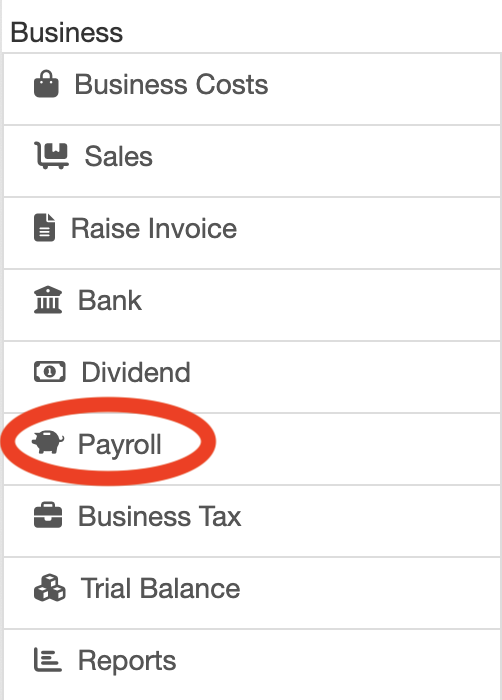

From the left hand menu select “Payroll” under “Business”.

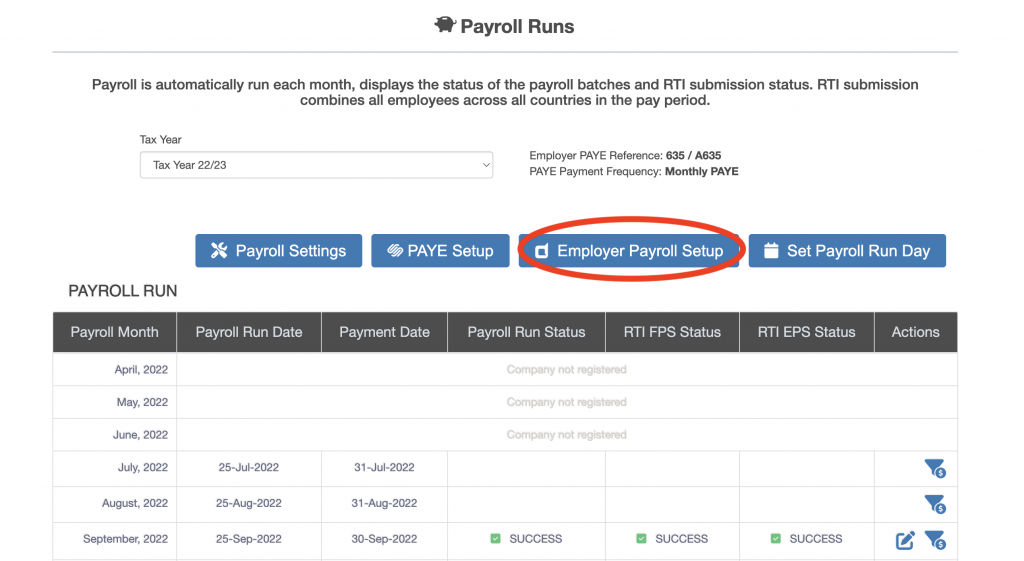

The Payroll screen is displayed. Press the “Employer Payroll Setup” button (circled in red below).

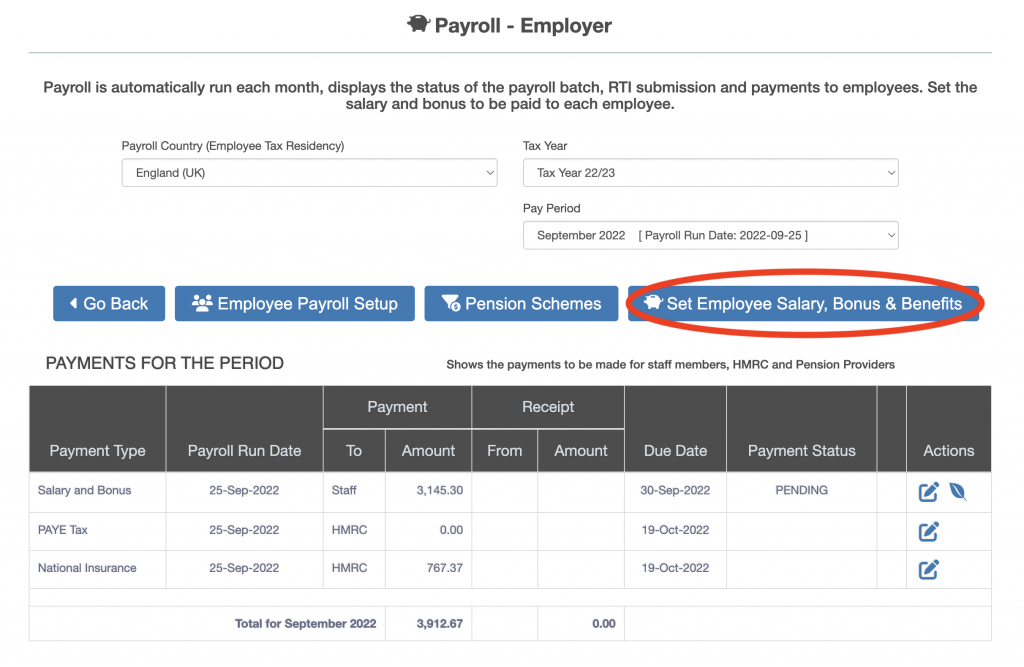

The “Payroll – Employer” screen is displayed. Press the “Set Employee Salary, Bonus & Benefits” button (circled in red below).

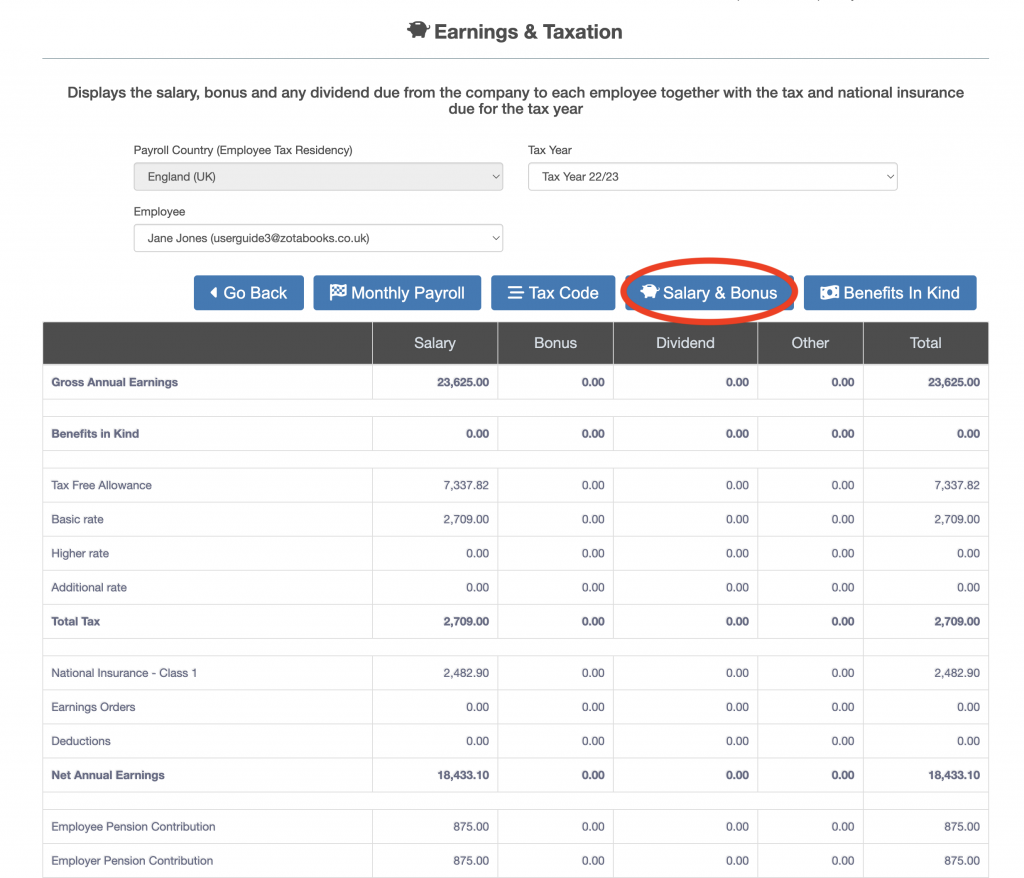

The “Earnings & Taxation” screen will be displayed. Press the “Salary & Bonus” button (circled in red below).

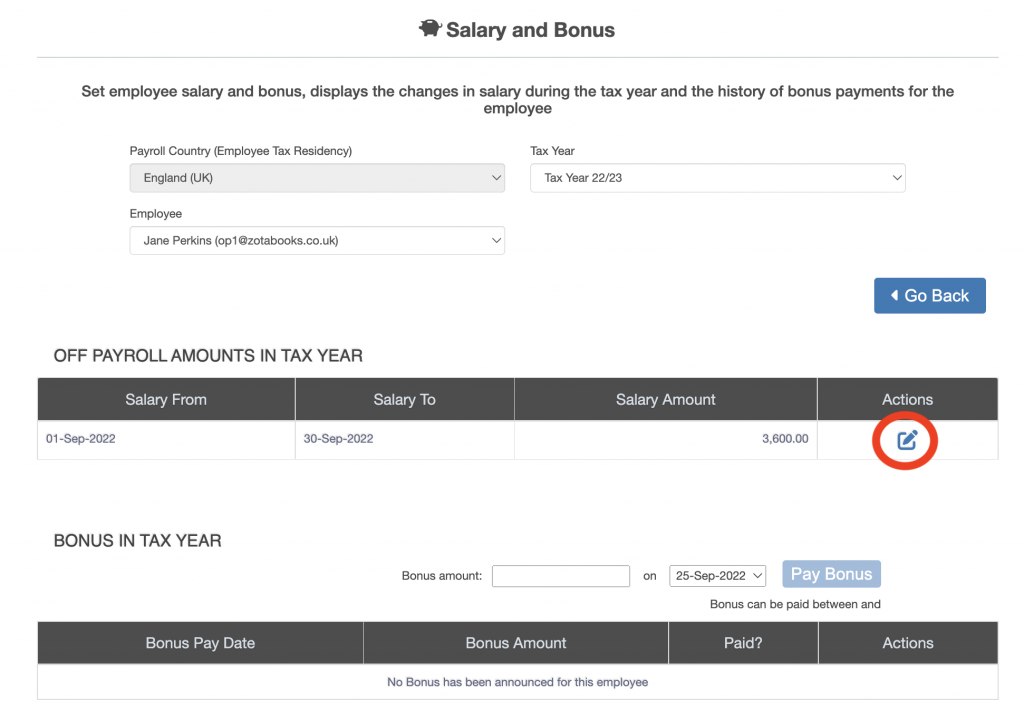

The “Salary and Bonus” screen will be displayed. The amounts payable to the off-payroll worker based on the timesheet entry is displayed under “Off Payroll Amounts in Tax Year”. Click the “Edit” icon (circled in red below) next to the month under the Actions heading to view what the payment is made up of (daily breakdown).

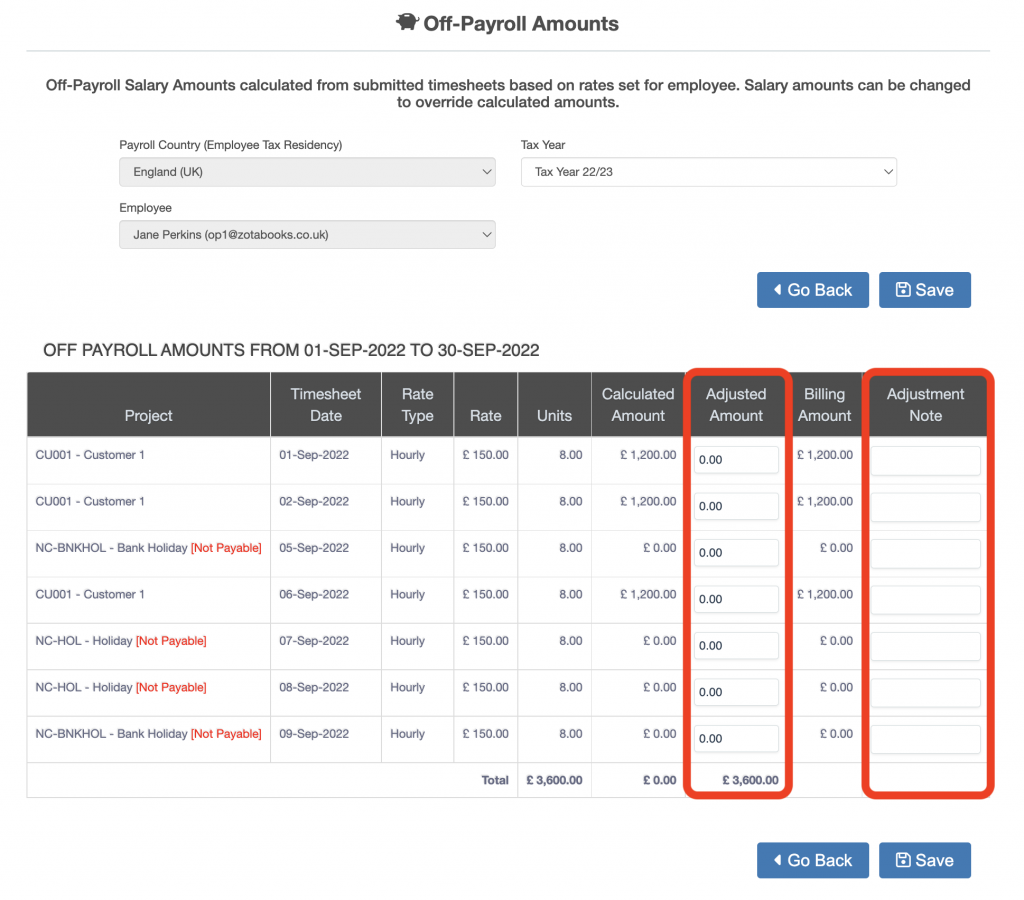

The “Off Payroll Amounts” screen is displayed. The screen breaks down the payment for the month by day, showing how the amount was calculated. The amount payable each day can be adjusted and a reasons provided (outlined in red below).

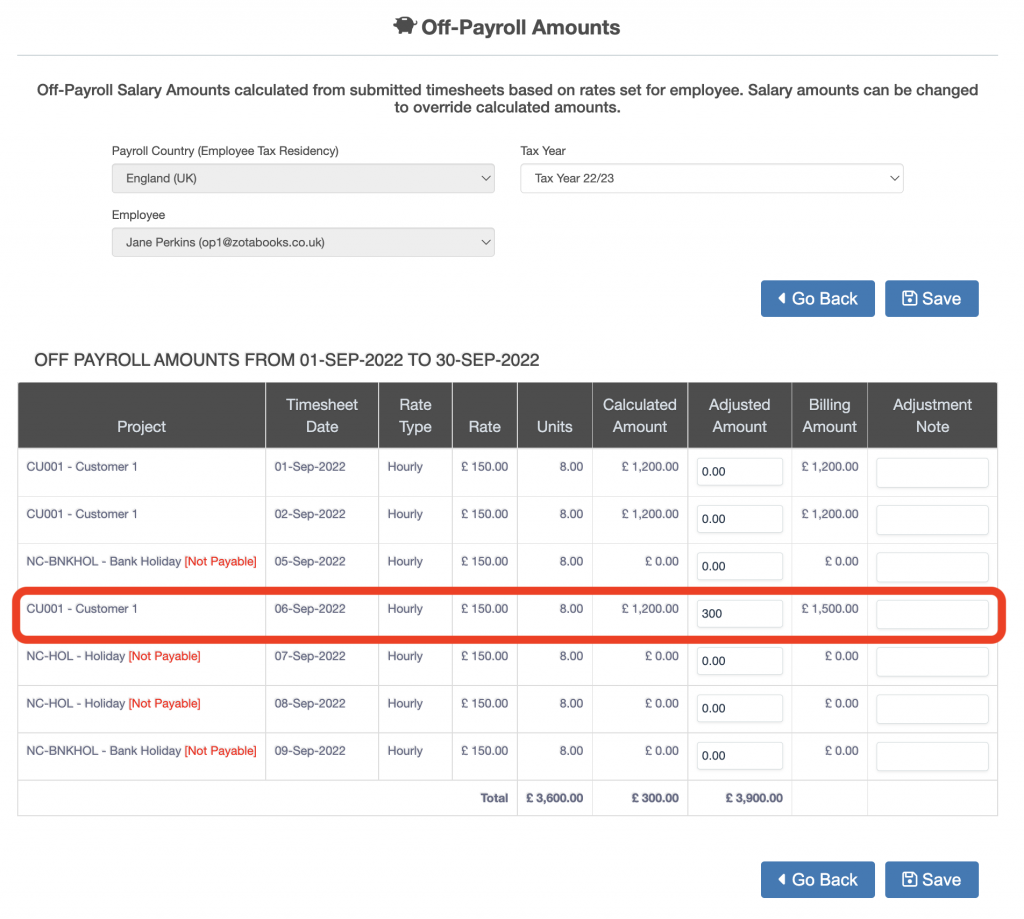

To edit the amount payable in a day, enter the amount to be added to the calculated amount against the relevant day and project code. A positive amount enter adds to the “Calculated Amount” and is displayed under “Billing Amount” (outlined in red below). A negative amount subtracts.

The totals at the bottom show the revised total under “Billing Amount”. Press the “Save” button when complete. The “Salary and Bonus” is displayed, the “Salary Amount is updated (circled in red below).