Payroll User Guide – Payroll Runs – Employer Payroll Setup – Employee Payroll Setup – Setup Employee or Contractor

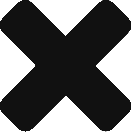

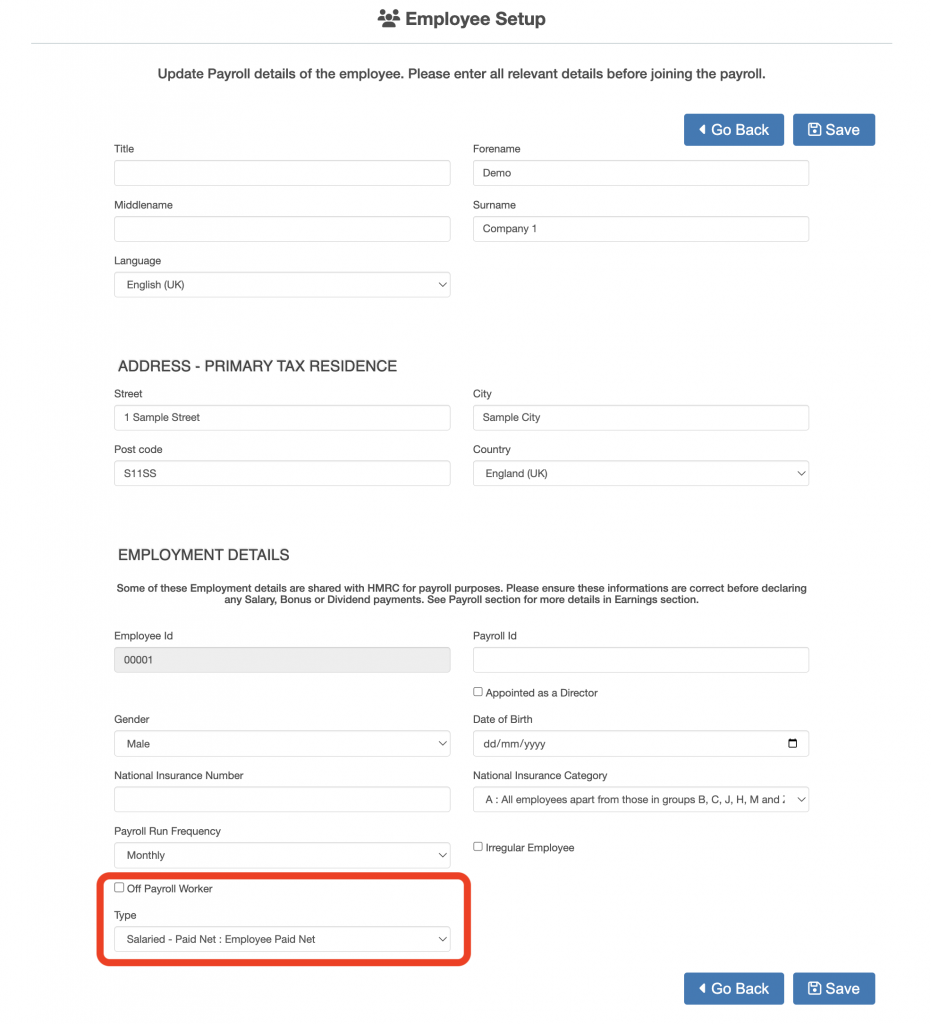

The employee or contractor setup screen is populated from details already entered into ZotaBooks about the employee or contractor in the screen below:

Check all details on the screen are correct, unless previously entered the following information will need to populated:

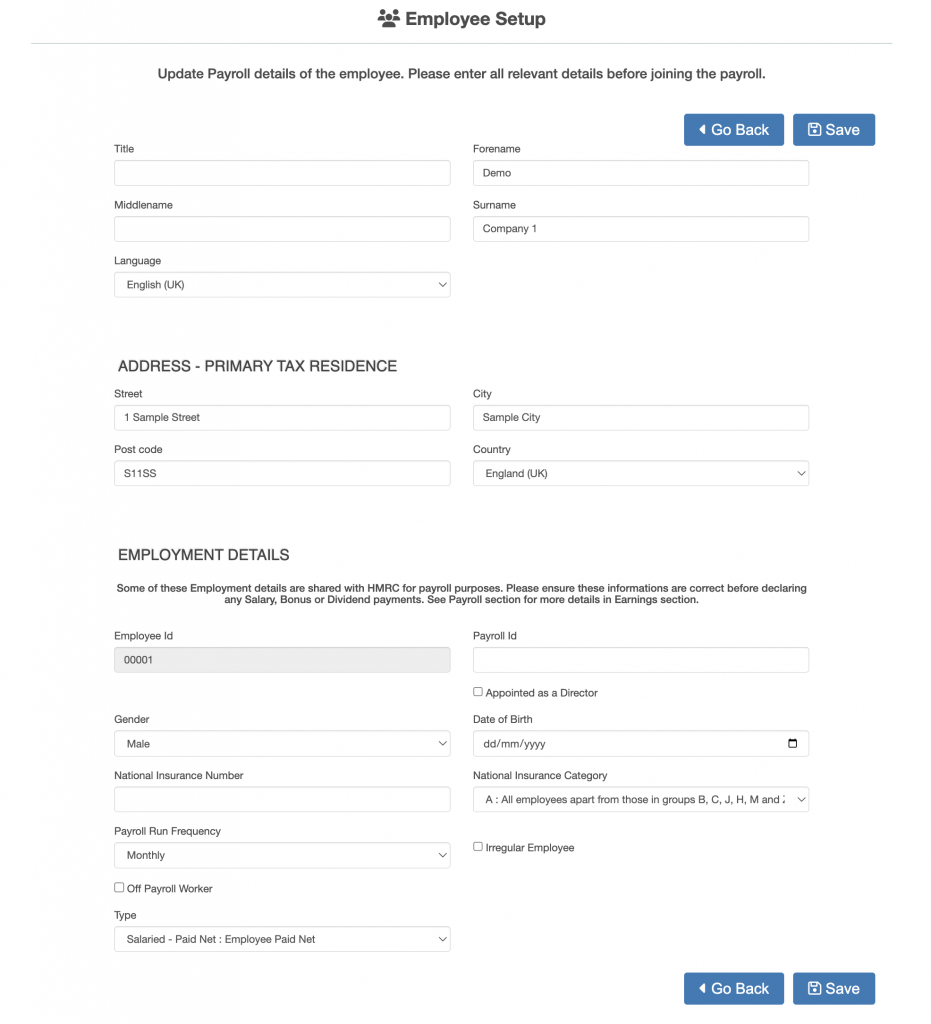

- Payroll Id (Mandatory)

- Appointed as Director (tick if director else leave unticked)

- Date of Birth (Mandatory)

- National Insurance Number (Mandatory)

This information will be submitted to HMRC as part of the RTI submission and is outlined in red in the screen below:

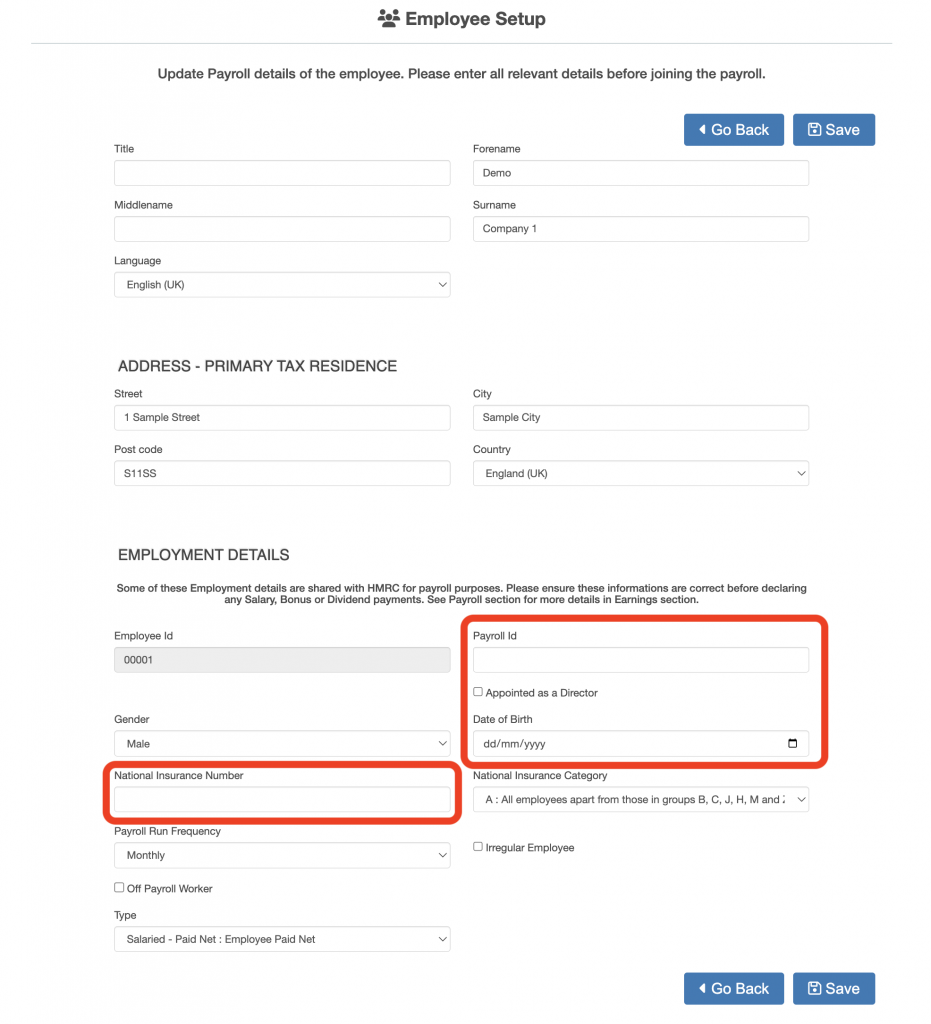

A user is added as an employee by default, to make the user a contractor tick the “Off Payroll Worker” tick box. The “Off Payroll Worker” tick box (outlined in red below) becomes enabled after the employee has joined the payroll. Click here to see how to add an employee or contractor to the payroll.

If the employee does not work regular hours (e.g. zero hours worker) then tick the “Irregular Employee” tick box, this information is submitted to HMRC in the RTI submission.

Once the details have been entered press the Save button.

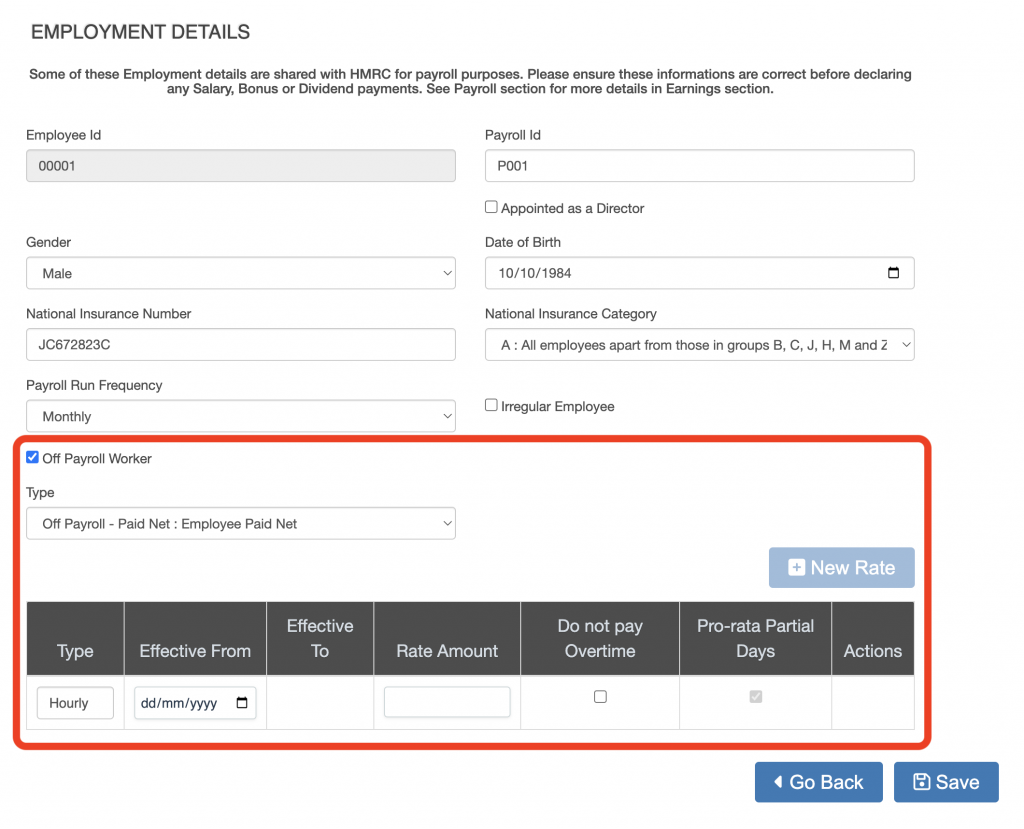

Setting a User as a Contractor

Once the user has joined the payroll (Click here to see how to add an employee or contractor to the payroll), the user can be set as a contractor by ticking the “Off Payroll Worker” tick box (outlined in red below).

Once the “Off Payroll Worker” tick box is ticked the rate box is displayed (outlined in red below).

Select the off payroll worker type:

- Off Payroll – Paid Net : Employee Paid Net = Employee is paid after deductions for tax and national insurance

- Off Payroll – Paid Gross : Employee Paid Gross = Employee is paid without deductions for tax and national insurance

In the table a rate amount must be entered, the information to be provided is:

- Type = paid hourly or daily.

- Effective from = the date from which the rate is effective from (the rate can be changed over time).

- Rate amount = the hourly or daily amount the contractor is paid.

- Do not pay Overtime = the maximum amount paid for an hourly contractor is equal to the standard working hours for the day (click here to see how to set standard working hours).

- Pro-rata Partial Days = where an employee works less than the standard working day the employee is paid a pro-rata amount of the daily rate (only effective for daily rates).

Once the details have been entered press the Save button.