Payroll User Guide – Post Payroll Adjustments

Once the payroll has been run, any changes to amounts payable can only be made using post payroll adjustments. Changes before the payroll has run are to be made as normal.

How to Make Post Payroll Adjustments

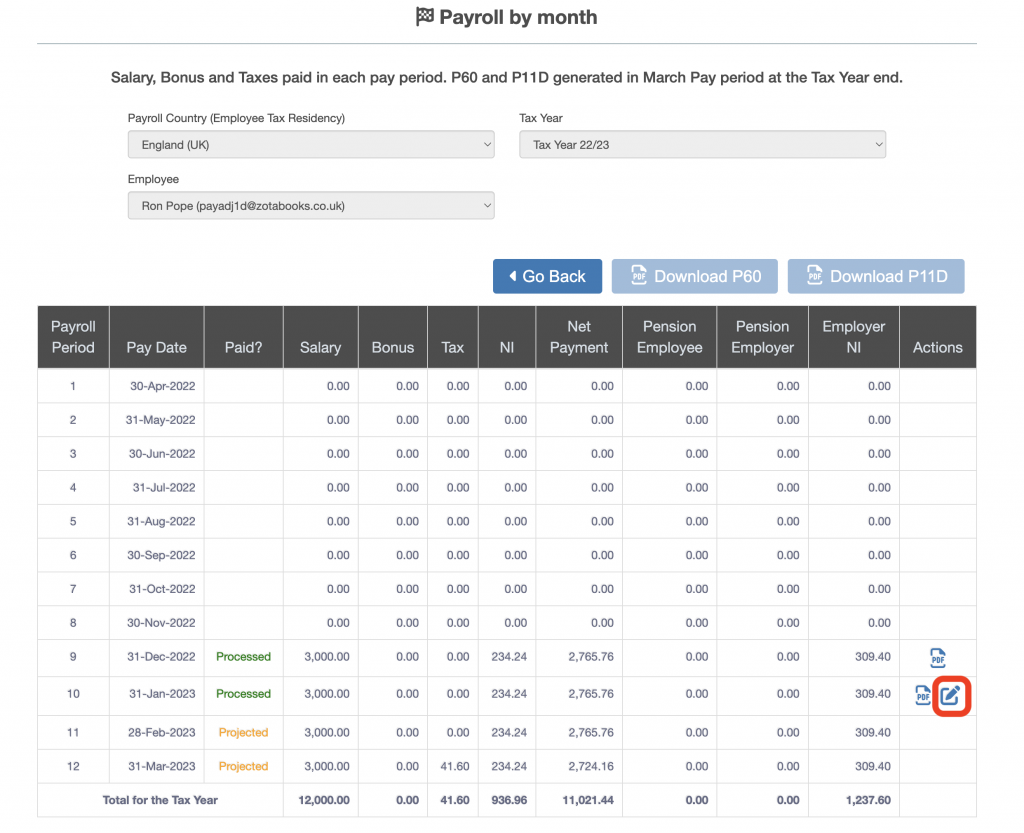

Go to Payroll -> Employer Payroll Setup -> Set Employee Salary, Bonus & Benefits -> Monthly Payroll. The list of monthly payroll payments made and projected for the tax year is displayed.

The latest month has an icon which shows allows the payroll amounts to be edited (outlined in red below), this is only available before accounting entries are made to the ledger (click here to learn how to reverse payroll accounting entries to enable changes to be made).

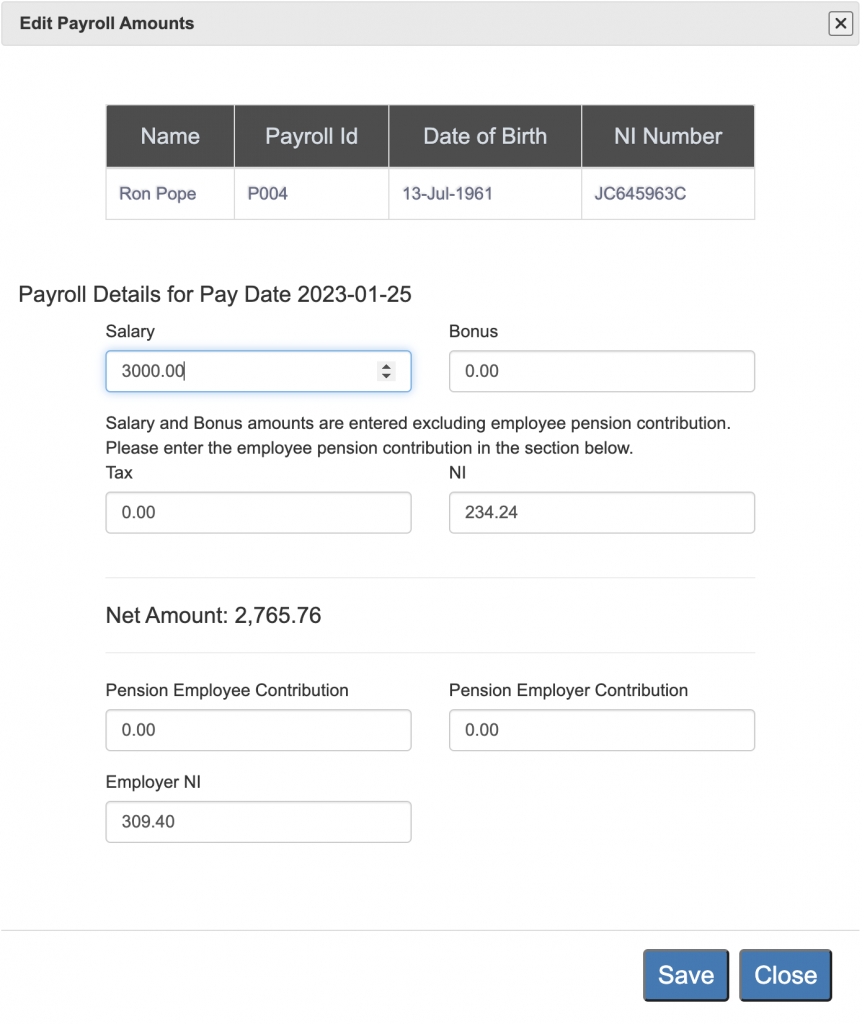

Click on the post payroll adjustment icon, then the post payroll adjustment screen is displayed (shown below).

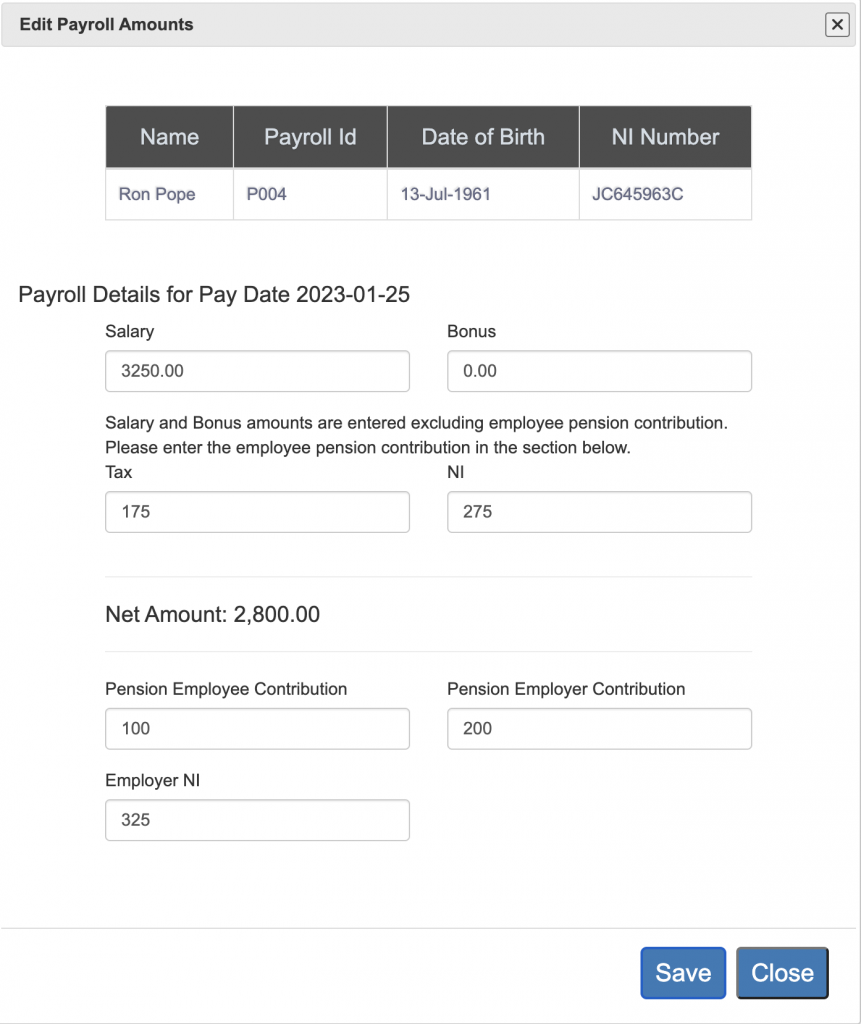

Make the changes to the amounts required, an example of changes is shown below.

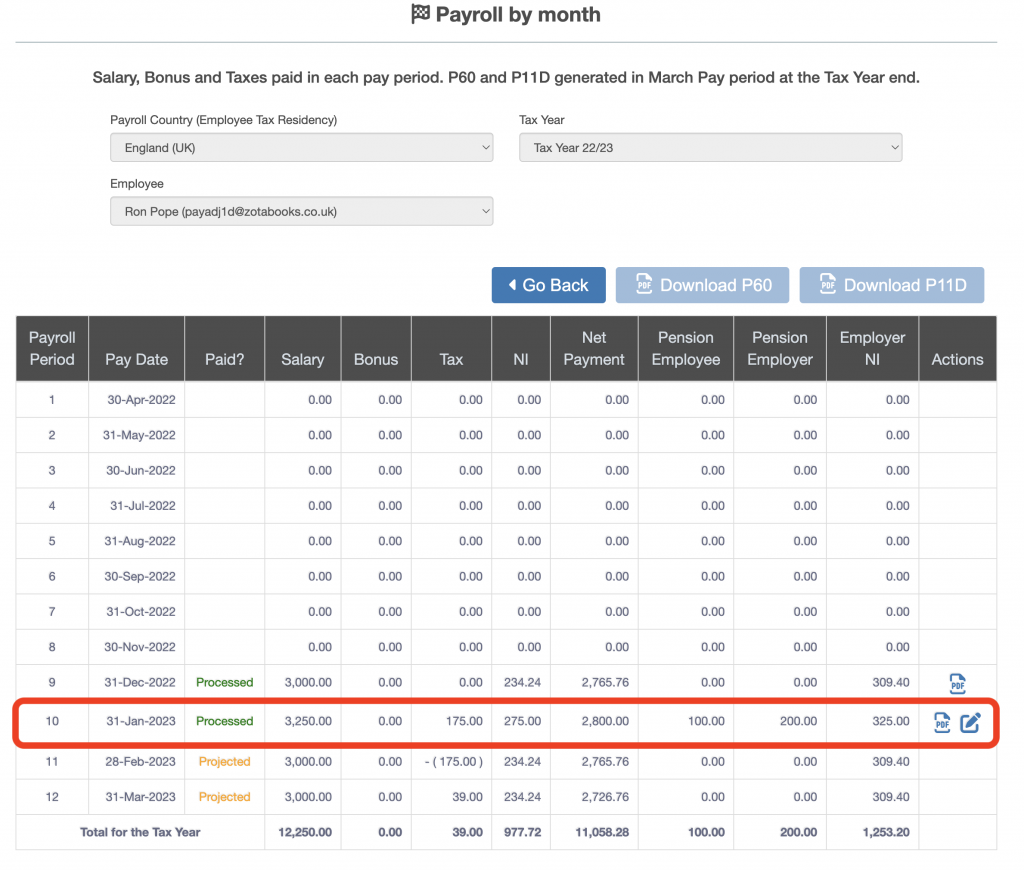

Once the required changes are made, press the “Save” button. The list of monthly payroll payments made and projected for the tax year is displayed, with the changes applied (see below).

Projected payroll payments are recalculated taking into account the new adjustment payment and entered tax, national insurance & pension amounts.