RTI Subscription Setup User Guide

Real Time Information (RTI) requires that employers must (in general) send pay details to HMRC on or before the date they pay their employees.

ZotaBooks automatically submits pay information to HMRC through RTI when the payroll is run, to enable this the business must be subscribed (logged into) to HMRC RTI using the log in details provided by HMRC.

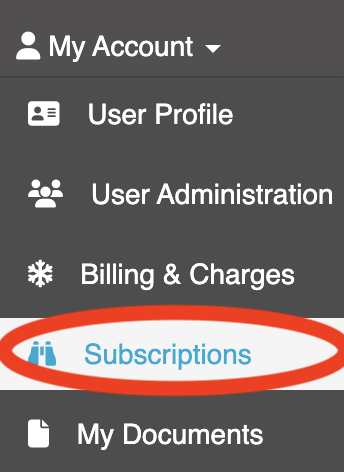

To subscribe to HMRC RTI go to the “My Account” menu at the top right hand side of the screen, select “Subscription” from the menu (see below).

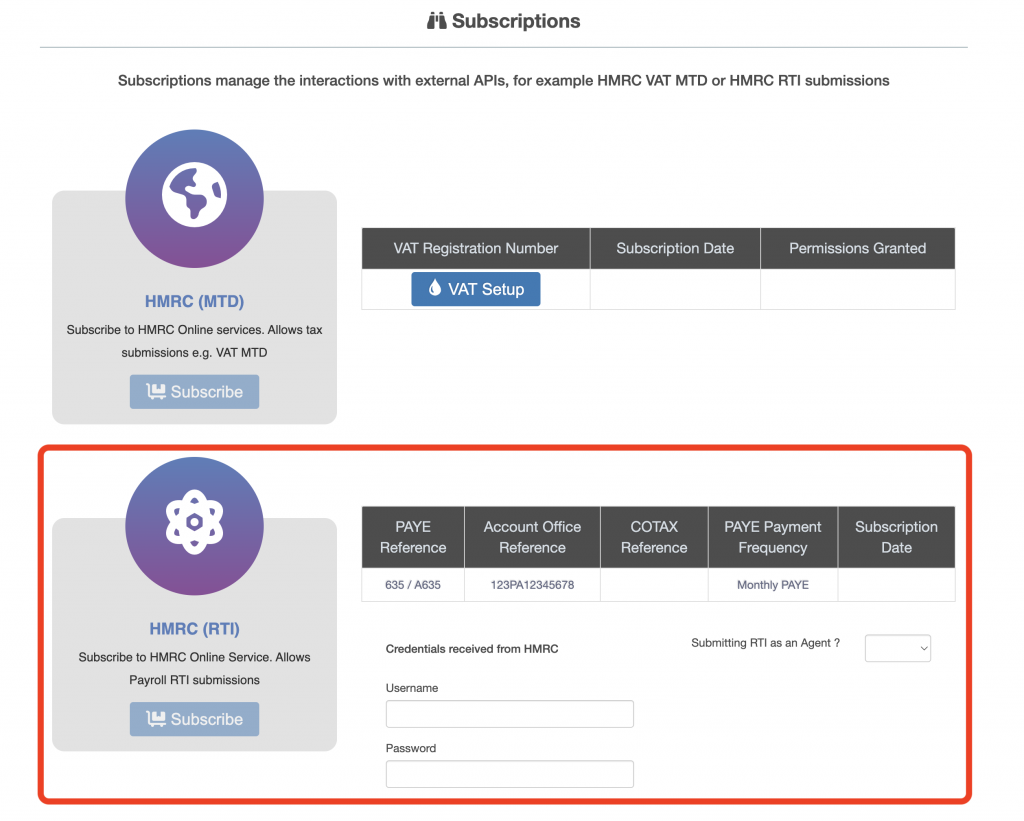

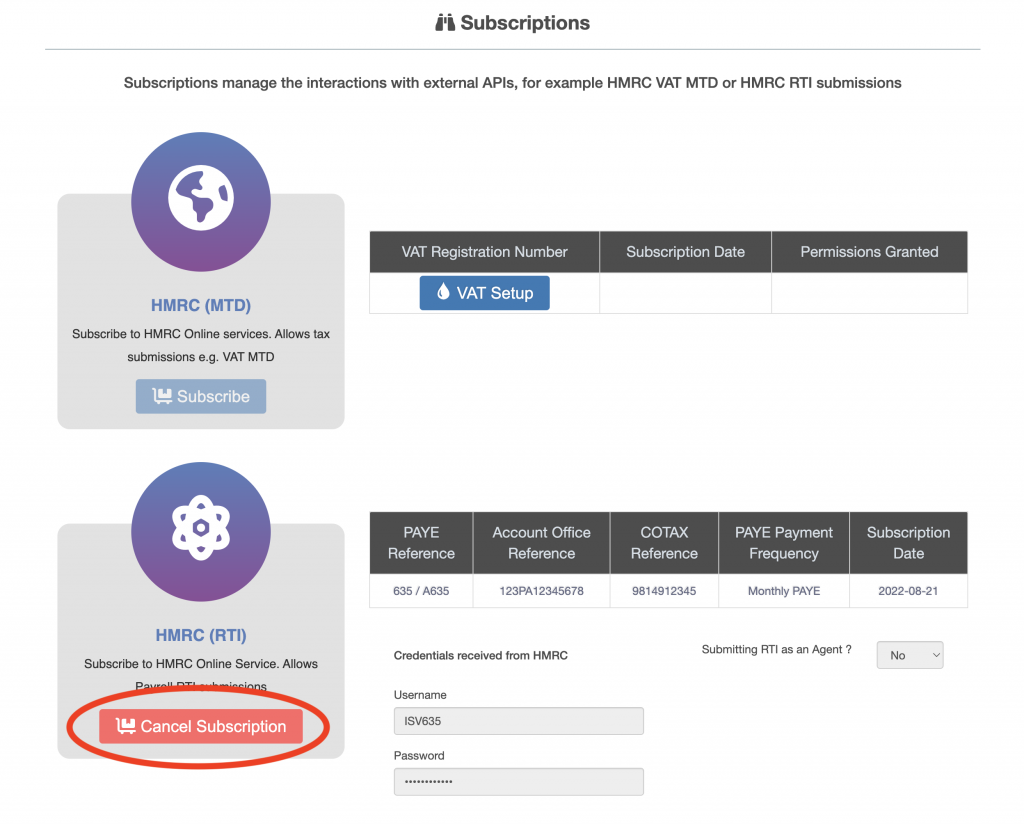

The list of subscriptions is displayed, one of which is “HMRC (RTI)”.

Complete the following information:

- Username, the user name provided by HMRC to log into HMRC for the business.

- Password, the password provided by HMRC to log into HMRC for the business.

- Submitting RTI as an Agent?, select Yes if you are submitting RTI on behalf of the business and are an external advisor to the business, select No if you are submitting RTI for the business and are part of the business.

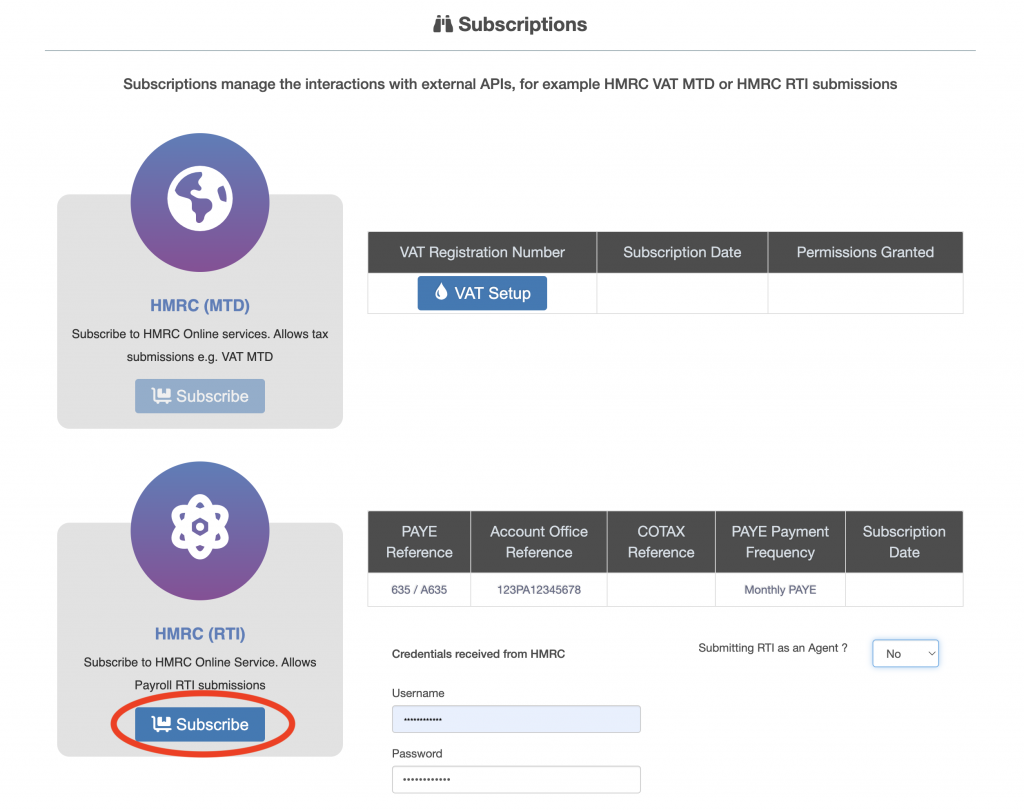

Once the details have been entered the “Subscribe” button will become enabled (button circled below in red).

Press the “Subscribe” button, ZotaBooks will connect to the HMRC RTI account for the business. If the connection is successful a message to confirm the connection to HMRC RTI has been established will the displayed, the “Subscribe” button for HMRC (RTI) will change to a red colour titled “Cancel Subscription”.

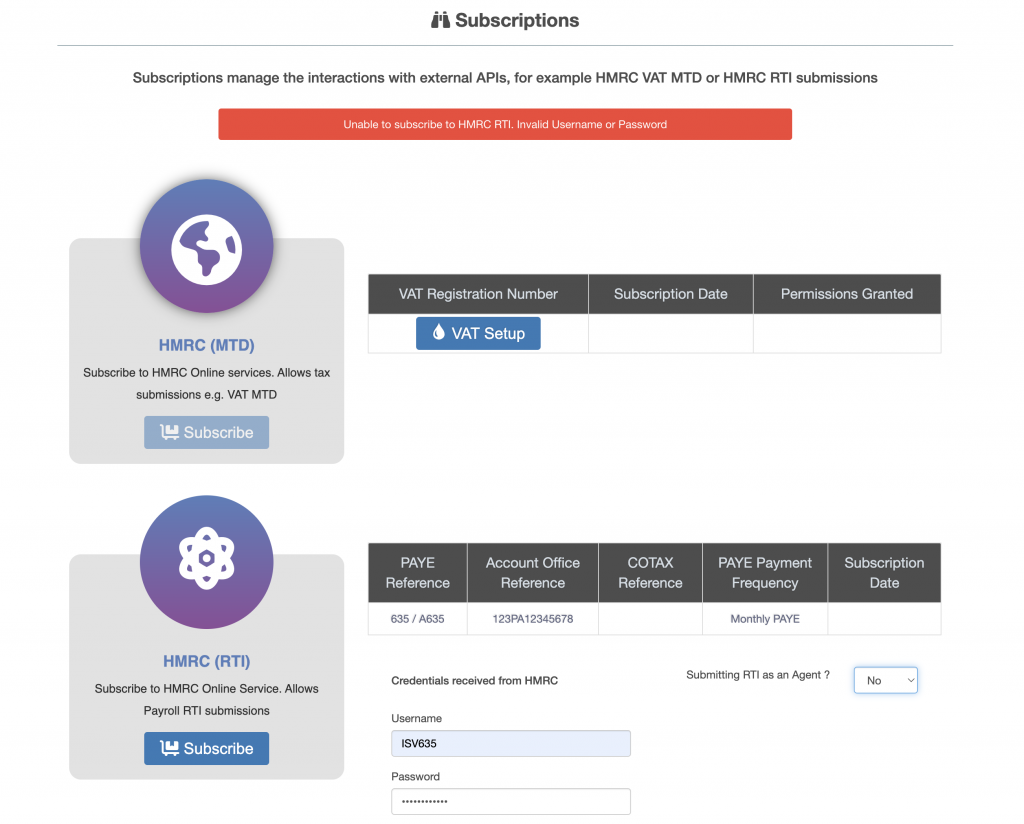

If the connection is unsuccessful a message to confirm the connection failure to HMRC RTI will the displayed.