Construction Industry Scheme Tax is deducted where the company is registered as a contractor under the scheme and the invoice received is for a sub-contractor.

Setting a Company as Subject to CIS in ZotaBooks

See How to Set a Company as Subject to CIS ?

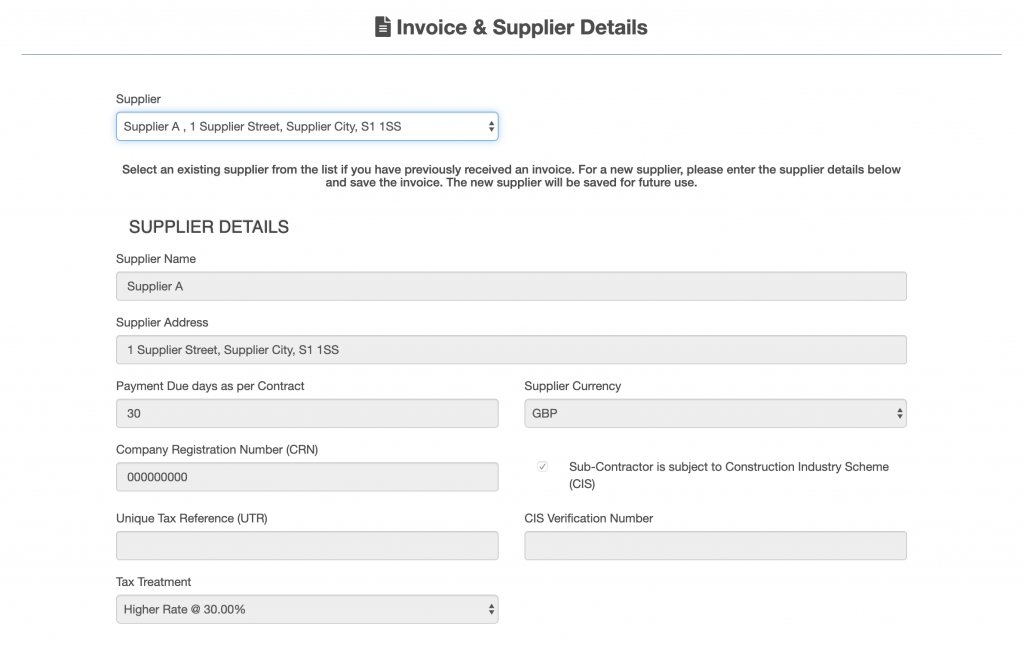

Setting a Supplier as Subject to CIS in ZotaBooks

See How to Set a Supplier as Subject to CIS ?

Entering an Invoice Received and Deducting CIS

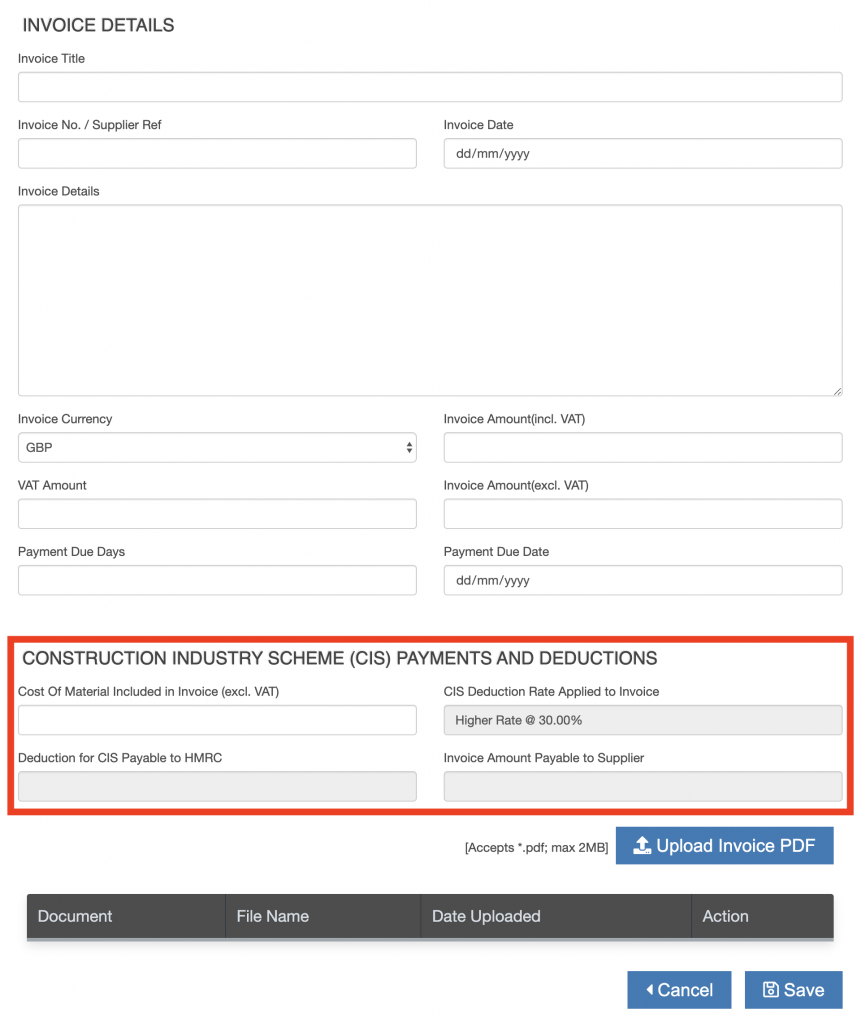

When a company is a contractor under CIS and a supplier which is a sub-contractor under CIS is selected, the CIS features of the invoice received enable.

Enter the invoice details, additional data items are required for an invoice received which is subject to CIS.

Complete as per an existing invoice. See How do I use the Invoice Received App ?

In addition to the steps in require to complete an invoice received, the following CIS information is to be added:

- Cost of Material Included in Invoice (excl. VAT)

The following data items are automatically populated:

- Deduction for CIS Payable to HMRC

- Invoice Amount Payable to Supplier

The two data items are populated using the “CIS Deduction Rate Agreed to Invoice” entered against the invoice received.