RTI stands for Real Time Information. This is the mechanism which must be used by employers to send details to HMRC at the time they pay their employees. This information must be sent to HMRC electronically as part of their routine payroll process.

Whenever payroll is run in ZotaBooks a submission is sent to HMRC, to enable the submission to succeed a business must subscribe to RTI in ZotaBooks.

Select payroll on the left-hand side menu, the main payroll screen appears.

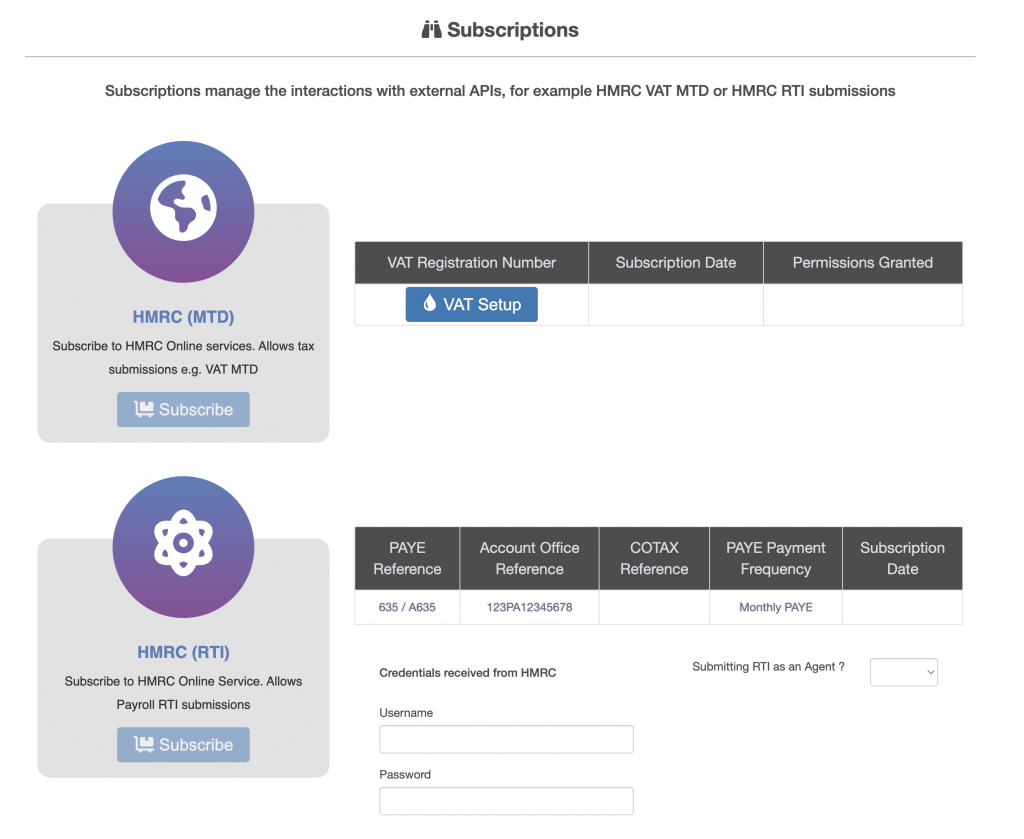

Press the “Subscribe to RTI” button, the Subscriptions screen is displayed.

To subscribe to HMRC (RTI) enter the username and password supplied by HMRC, select whether submitting as an agent for the business or as the business. The “Subscribe” button is enabled, press the button and ZotaBooks will connect to HMRC for RTI submission.