VAT MTD is mandatory for most companies with a turnover greater than the threshold defined by HMRC. See HMRC website for information.

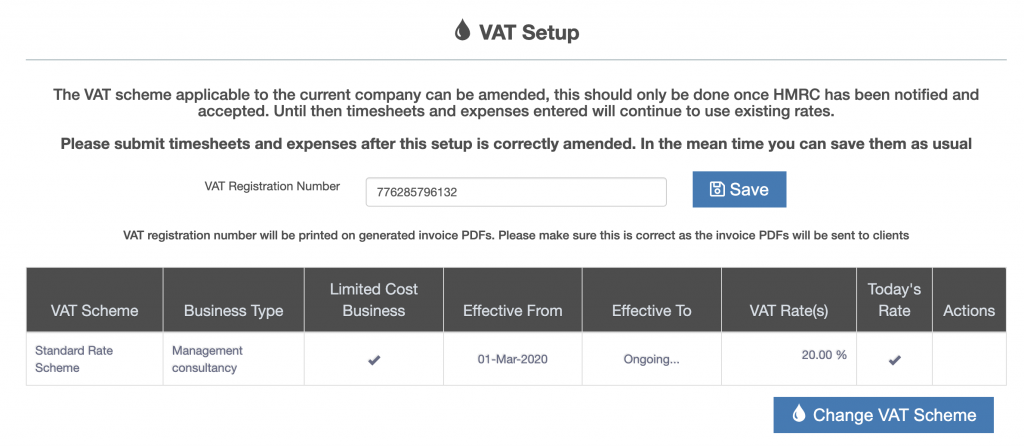

Adding VAT number to ZotaBooks

Every company which is registered for VAT will have a VAT registration number. This needs to be added to ZotaBooks. To add the VAT number to ZotaBooks goto the following menu items:

Personalisation -> VAT Setup

Type in the VAT registration number and press the “Save” button.

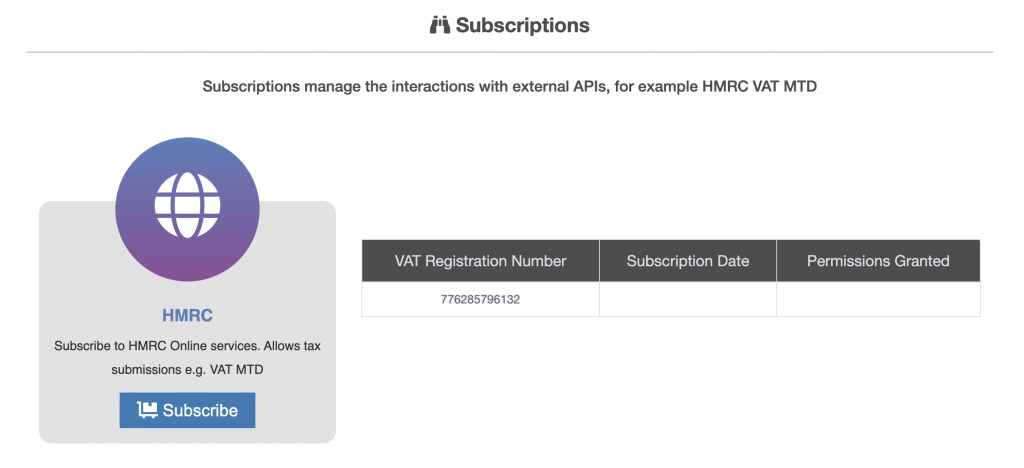

Subscribe To HMRC VAT MTD

To subscribe to HMRC VAT MTD follow the menu items:

My Account -> Subscriptions

Press the “Subscribe” button. The HMRC sign up page will be displayed.

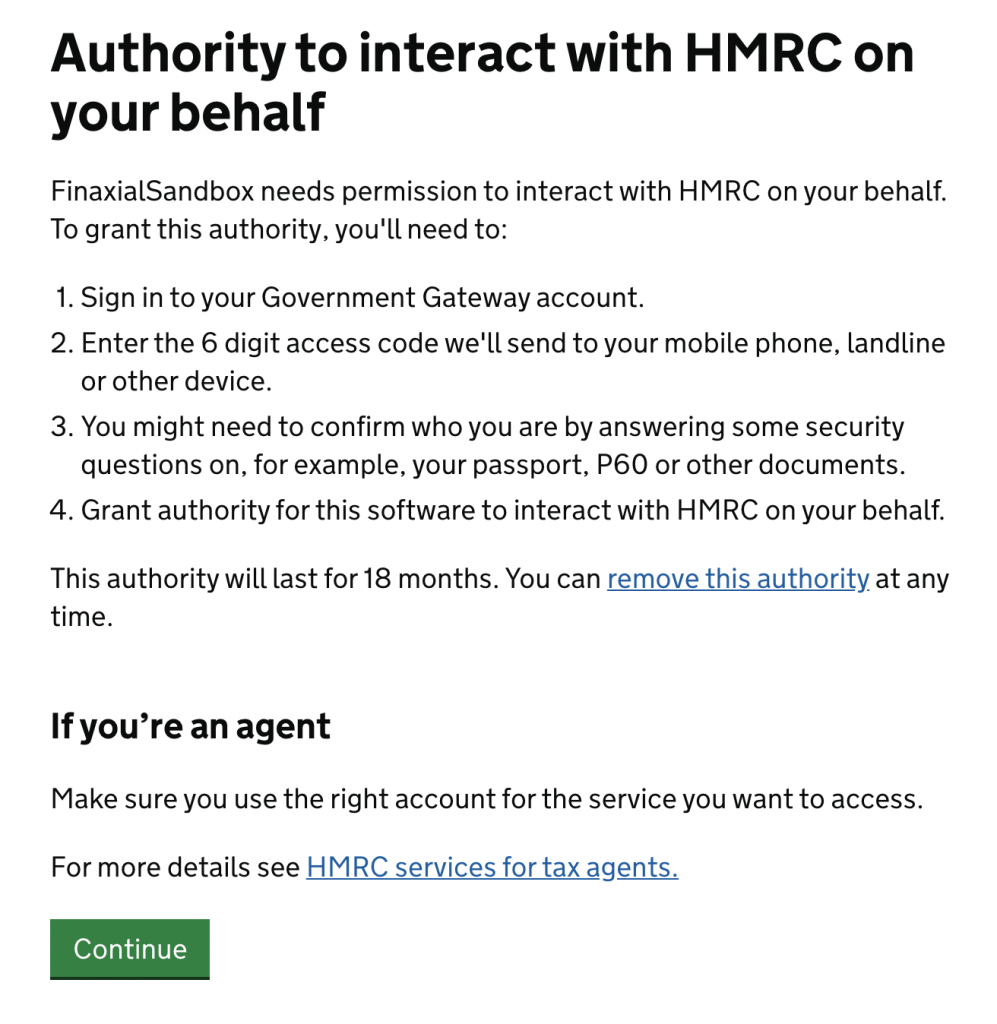

Press the “Continue” button to proceed with linking ZotaBooks to HMRC VAT MTD. The HMRC sign in screen is displayed.

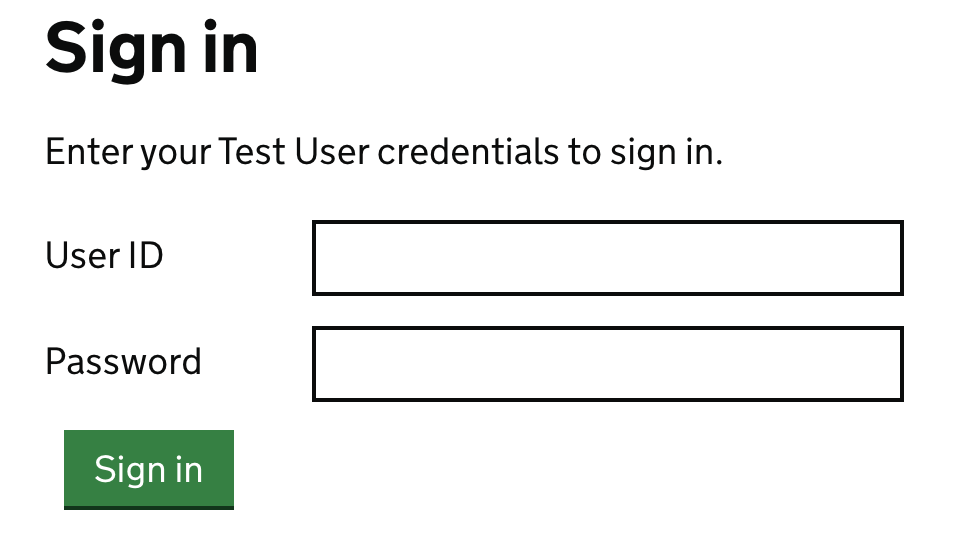

Enter the HMRC sign in credentials, and press the “Sign in” button.

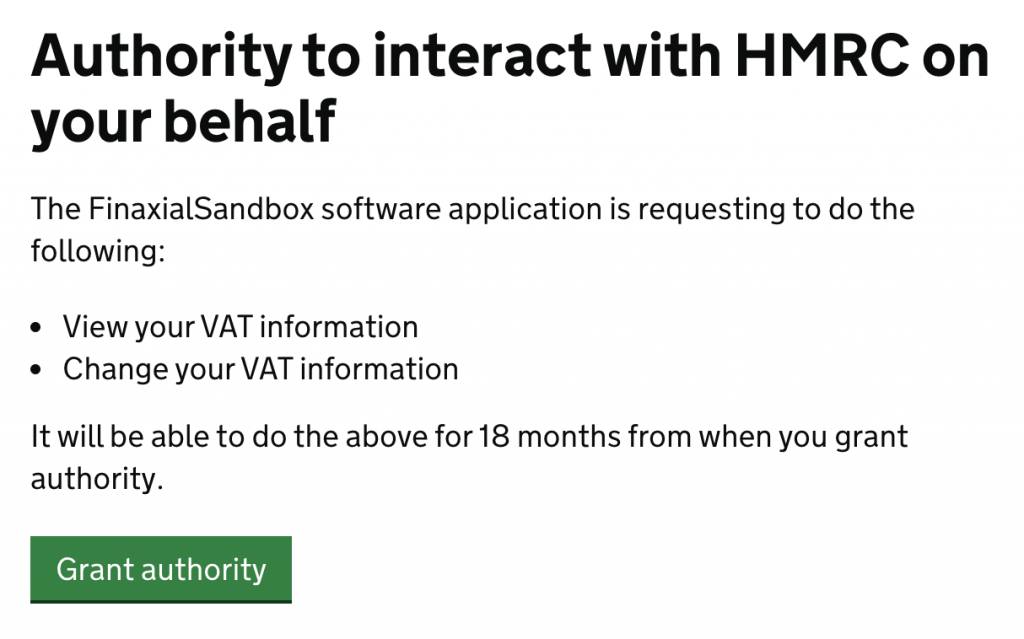

The screen informs that ZotaBooks will have permission to both VIEW and CHANGED VAT information for the period stated from the grant of authority.

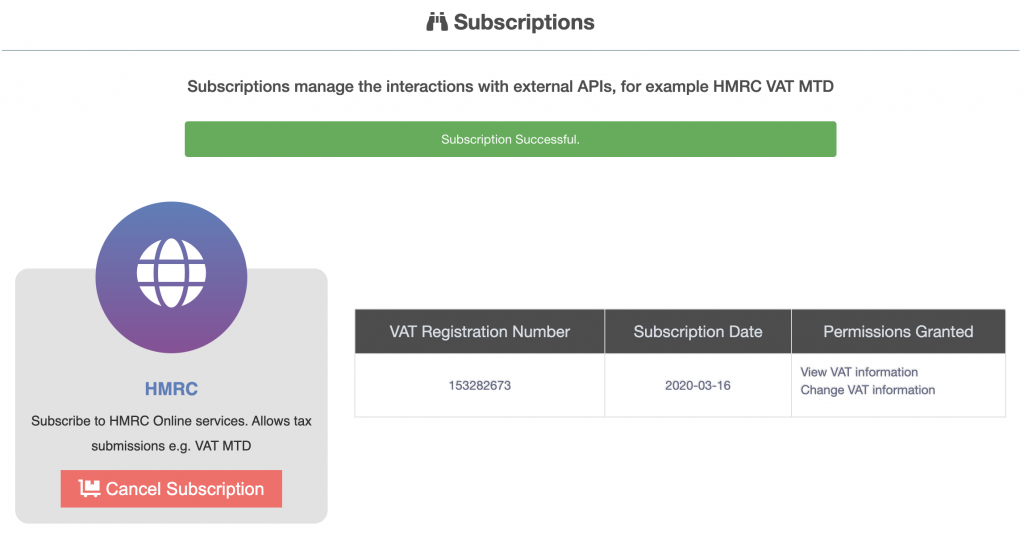

ZotaBooks is now subscribed to HMRC. To cancel the subscription press the “Cancel Subscription” button.