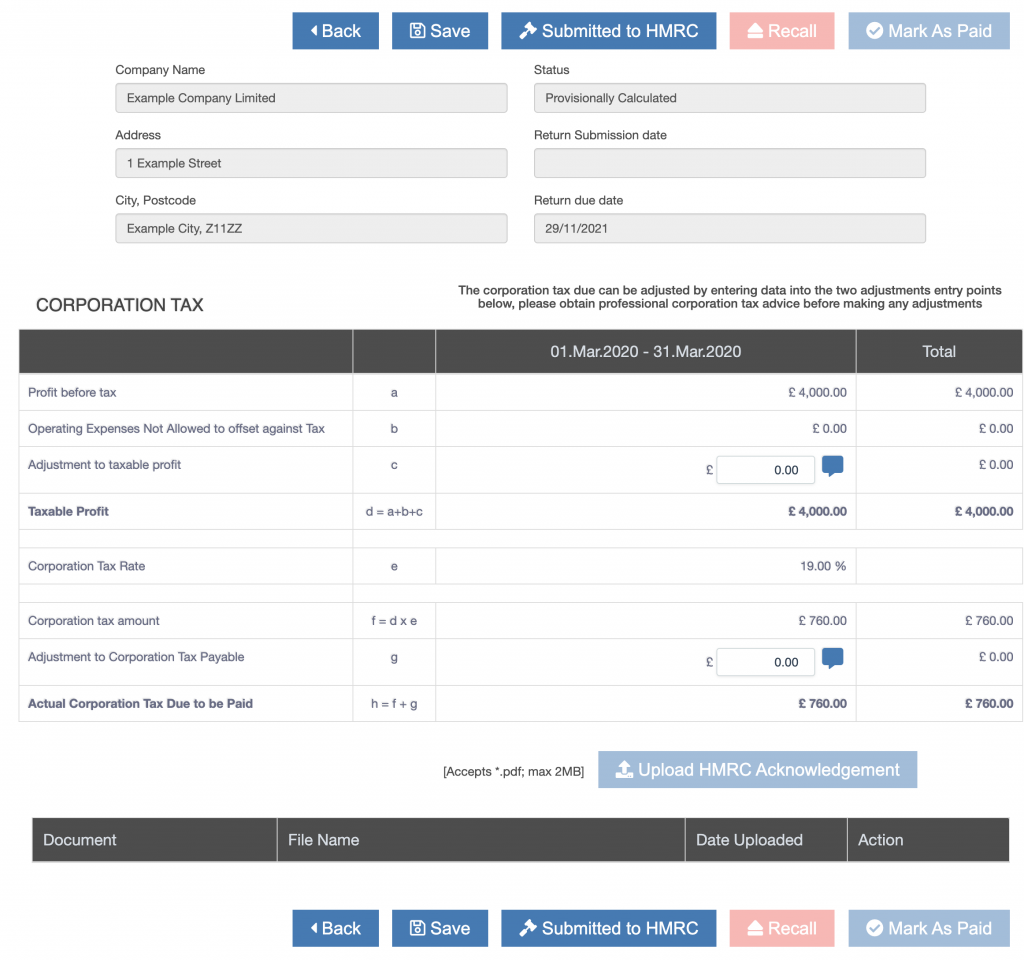

Corporation tax is automatically populated from the other entries made into ZotaBooks, the income less allowable expenses is the taxable profit which then has the prevailing corporation tax rate applied.

Adjustments can be made directly into the adjustments boxes (c and g) on the corporation tax screen, or through the trial balance accounting adjustments application.

Finalising the Corporation Tax

The corporation tax for an accounting year requires locking when finalised, this is done by pressing the “Submitted to HMRC” button.

To make changes after marking as “Submitted to HMRC”, press the “Recall” button.

Corporation Tax Paid

Once the corporation tax is paid, press the “Mark as Paid” button, the appropriate accounting entries are made, recording the payment from the bank account in the financial records.