ZotaBooks is a powerful integrated cloud based business and accounting eco-system, providing a wide set of features and capabilities to support business.

Setting Up Your Company

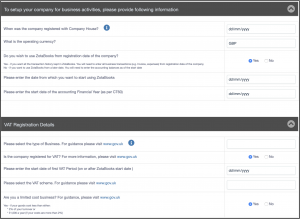

ZotaBooks asks you to setup a company on first login, until the company has been setup each time you login you will see the company setup screen.

ZotaBooks asks questions which enables your company to be setup, the questions are divided into two sections:

- Questions about the company

- Questions about the VAT registration of the company

Let’s cover the questions about the company and what they mean:

- When was the company first registered with Companies House ? This information is available on the companies Certificate of Incorporation. Click on the blue “i” icon to see an example of where to find the company registration number on the companies Certificate of Incorporation.

- What is the operating currency ? For now, this is defaulted to GBP, in the near future other currencies will be enabled.

- Do you wish to use ZotaBooks from registration date of the company ? Bringing in lots of history can be very time consuming, you can choose a date from which to start using ZotaBooks after the company registration date. If you choose “No”, then please amend the next two questions as appropriate, otherwise leave the values as defaulted.

- Please enter the date from which you want to start using ZotaBooks ? If the answer to the question above is “No” then enter a date otherwise leave as default. Typically, our users choose the start of the current accounting year.

- Please enter the start date of the accounting Financial Year (as per CT60). Please make the same as the question above.

Let’s cover the questions about the company VAT and what they mean:

- Please select the type of business. For guidance please visit www.gov.uk. When a company is registered for VAT the nature of the business is selected, this is shown on the VAT registration certificate. Please select the type in the drop down box. If the company is not registered for VAT choose the description which applies to your business.

- Is the company registered for VAT ? For more information, please visit www.gov.uk. If the company is NOT VAT registered enter “No”, other “Yes”.

- Please enter start date of the first VAT period (on or after ZotaBooks start date). If the company is VAT registered please enter the date from which the companies VAT registration began.

- Please select the VAT scheme. For guidance please visit www.gov.uk. When the company was registered for VAT it was either under the Flat rate or standard rate scheme. Please choose accordingly.

- Are you a limited cost business ? For guidance please visit www.gov.uk. If the company meets the requirements of a limited cost business then select “Yes” else “No”.

Press the “Save and Proceed” button once all information has been entered.

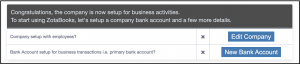

Employee and Bank Account Setup

Once the company has been created ZotaBooks asks for additional information about adding your first employee to your company and setting up the first company bank account. The screen below is displayed.

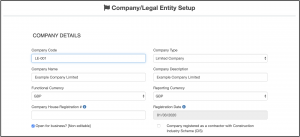

Press the “Edit Company” button and the company setup screen is displayed, as below.

Enter the following information to complete the setup:

- Company House Registration #

- Add the employee displayed in the text box at the bottom of the screen

- tick the Add / Remove selection

- enter a standard daily fee, if none then enter the value of zero (0)

- enter a base location for the employee (e.g. London)

All employees come setup with a standard working week of 8 hours per day Monday to Friday, to change this click on the icon under the “Action” column. This information is used by the timesheet application, it can be amended at a later date.

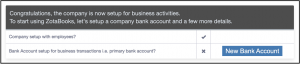

Once completed press the “Save” button. You will be taken back to the previous screen showing company is now complete.

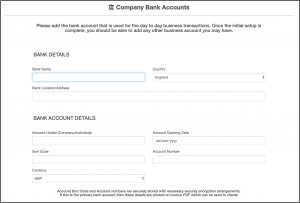

Each company needs at least one bank account, press the “New Bank Account” button to add this to ZotaBooks.

Enter the following information

- Bank Name (e.g. Natwest, Barclays)

- Bank Location Address, the bank address to which the bank account is registered (e.g. 111 Example Road, Example City, E1 1EE)

- Account Holder, the name of the account (e.g. Example Company Current Account)

- Account Opening Date, the date the account was opened with the bank account

- Sort Code, the bank account sort code. Enter as either XX-XX-XX or XXXXXX format (e.g. 99-99-99 or 999999)

- Account Number, the bank account number. This is limited to the number of permitted digits for a bank account.

- Currency, defaults to GBP. Will be extended to other currencies in the near future.

Sort code and bank account are stored encrypted in an encrypted database.

Once completed, press the “Save” button.

ZotaBooks is Ready to Use

ZotaBooks is ready to use, the dashboard is displayed.

You are ready to get going.